Compounding Kando: A Deep Dive into the One Sony Investment Thesis

From Sony Music Groups Global reach to PlayStation's recurring revenue to Crunchyroll's niche dominance, Sony is building a toll bridge across the global entertainment economy.

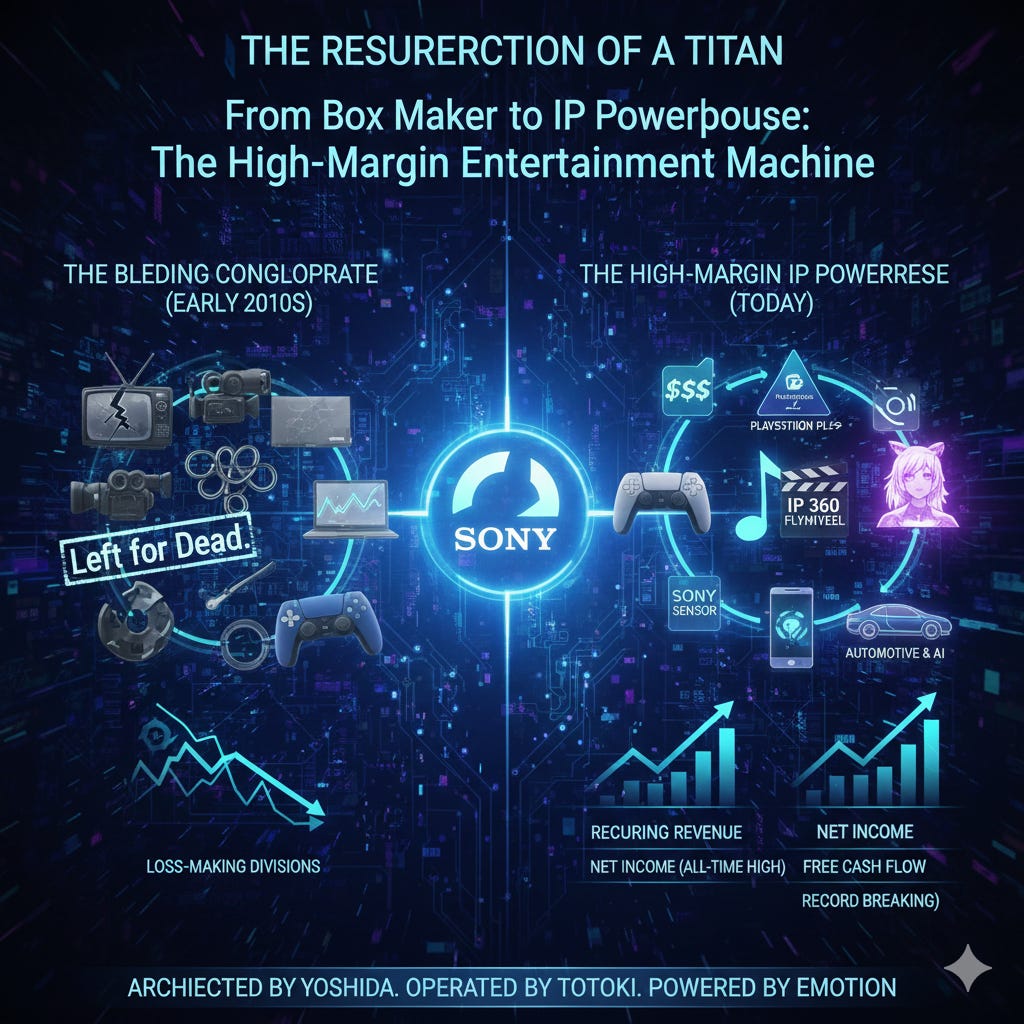

The Resurrection of a Titan

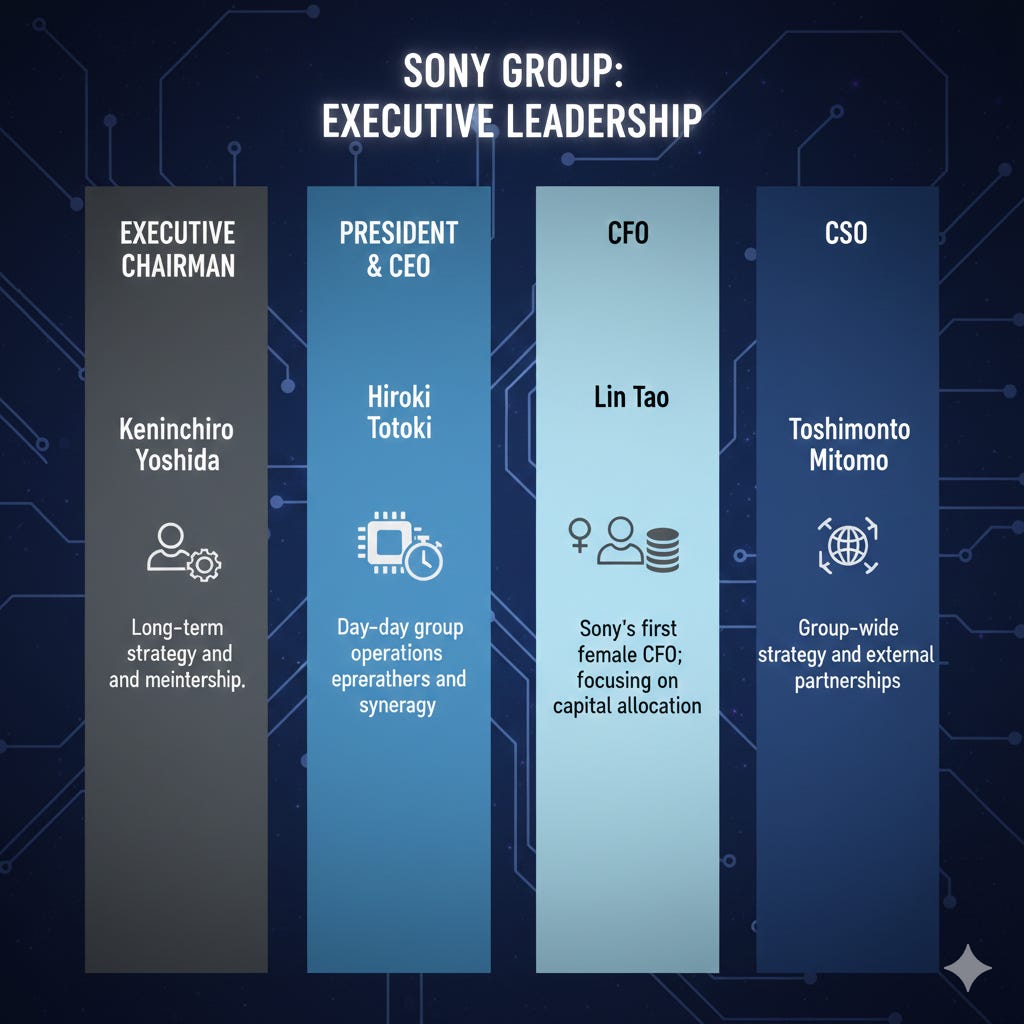

In the early 2010s, Sony was a sprawling, bleeding conglomerate that many analysts had left for dead. Today, it stands as a global creative entertainment powerhouse, having successfully navigated one of the most complex corporate turnarounds in history. Under the architecting of Kenichiro Yoshida and the operational precision of Hiroki Totoki, Sony has evolved from a box maker vulnerable to hardware cycles into a high-margin IP engine. By dominating the silent monopoly of image sensors, acting as the arms dealer in the streaming wars, and transforming PlayStation into a recurring service juggernaut, Sony has created a unique compounding flywheel. This deep dive explores how the One Sony strategy is turning human emotion into a predictable, high-yield financial machine.

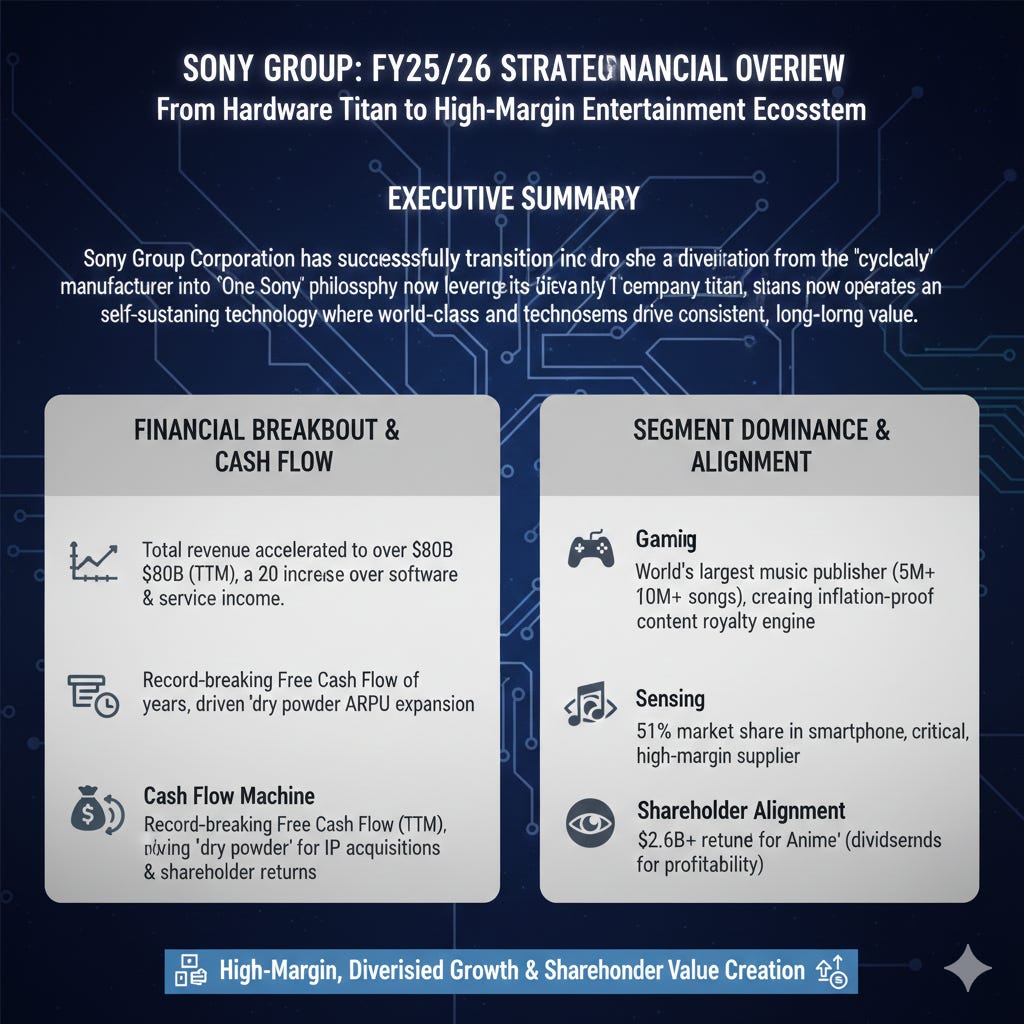

Executive Summary

Sony Group Corporation has successfully transitioned from a cyclical hardware manufacturer into a diversified, high-margin entertainment and technology titan. By leveraging its “One Sony” philosophy, the company now operates a self-sustaining ecosystem where proprietary technology and world-class content drive consistent, long-term value.

Strategic & Financial Highlights (2025-2026)

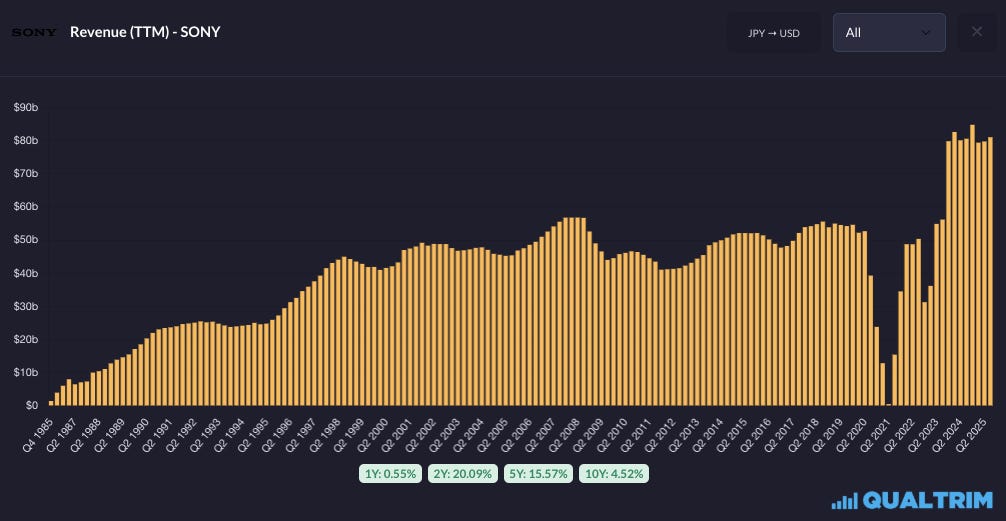

Financial Breakout: Total revenue has accelerated to over $80B (TTM), a 20% increase over the last two years, driven by a shift toward recurring software and service income.

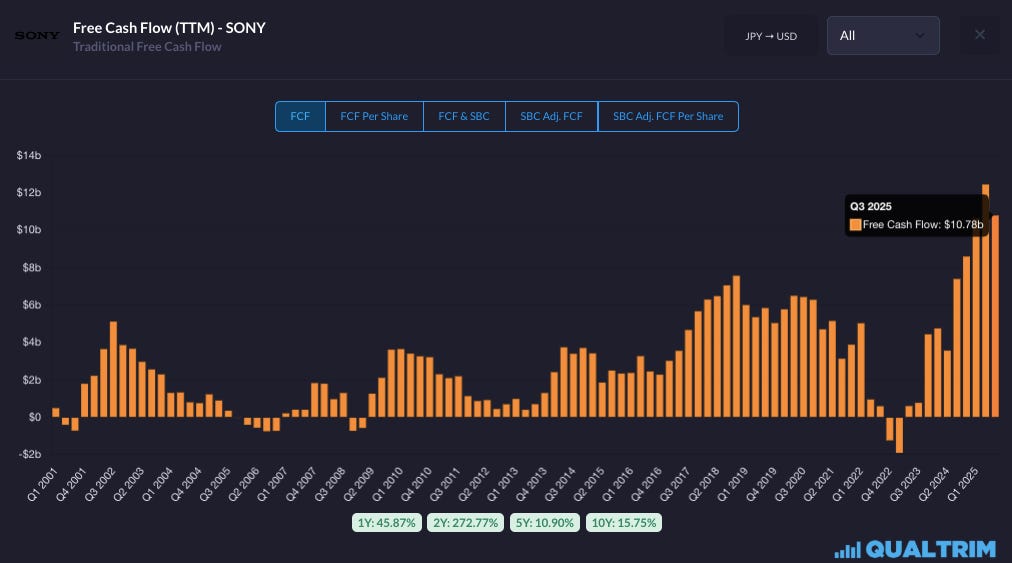

Cash Flow Machine: Sony is generating record-breaking Free Cash Flow of $10.78B (TTM), providing the “dry powder” needed for aggressive IP acquisitions and shareholder returns.

Segment Dominance:

Gaming: PlayStation has evolved into a $30B+ service platform, with PlayStation Plus tiers driving significant ARPU expansion.

Music: As the world’s largest music publisher, Sony owns or administers over 5 million songs, creating an inflation-proof royalty engine.

Sensing: Sony maintains a 51% market share in smartphone image sensors, acting as a critical, high-margin supplier to the entire mobile industry.

Niche Monopoly: Through Crunchyroll, Sony owns the global “Value for Anime,” recently pivoting to a mandatory paid model to maximize segment profitability.

Shareholder Alignment: Management has returned over $2.6B to shareholders through dividends and buybacks in the most recent periods.

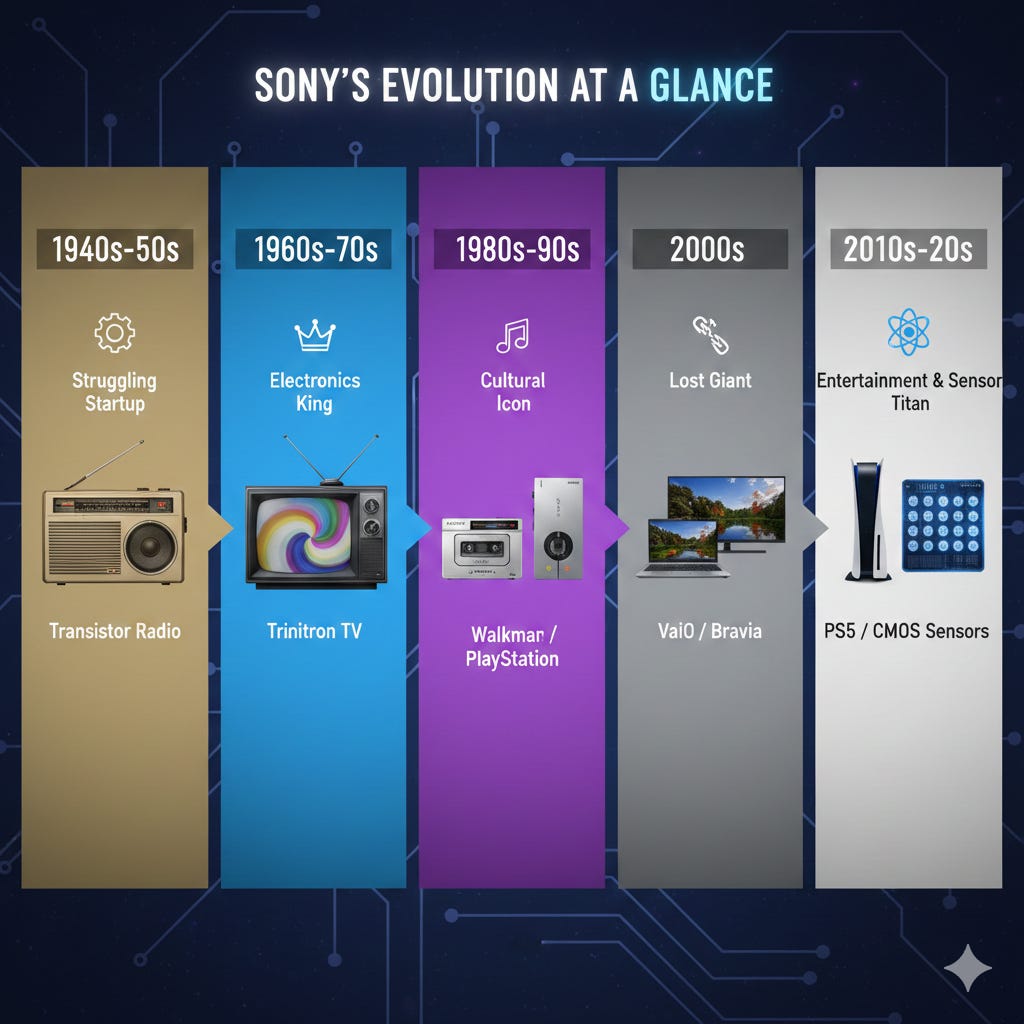

The Post-War Spark (1945–1957)

Sony began in the rubble of post-WWII Tokyo. In 1946, Masaru Ibuka (the engineer) and Akio Morita (the visionary marketer) founded Tokyo Tsushin Kogyo (Tokyo Telecommunications Engineering Corp) with just 20 employees and $500 in capital.

The First Failure: Their first product was an electric rice cooker that consistently overcooked or undercooked the rice. It never even went to market.

The Turning Point: In 1950, they launched the G-Type, Japan’s first magnetic tape recorder.

The Transistor Bet: While American companies were using transistors for military tech, Sony licensed the tech from Bell Labs to create the TR-55 (1955), Japan’s first transistor radio.

Global Ambition & The Name Change (1958–1978)

To become a global brand, they needed a name Westerners could pronounce. They mixed the Latin word sonus (sound) with the American slang “sonny boy” to create Sony (1958).

The Trinitron Era: In 1968, Sony launched the Trinitron color TV. It was vastly superior to competitors’ screens and solidified Sony’s reputation as the “premium” electronics brand.

The Format Wars: Sony launched Betamax in 1975. Despite having better picture quality, it famously lost the market to JVC’s VHS format because VHS offered longer recording times—a classic lesson in business school history.

The Walkman & Media Domination (1979–1993)

This era was defined by Sony moving from “making boxes” to “owning the content” inside them.

The Walkman (1979): Morita pushed for a portable cassette player despite internal skepticism that people wouldn’t want to listen to music without a recording function. It changed human culture forever.

The CD Revolution: Co-developed with Philips, the Compact Disc (1982) moved the world into the digital audio age.

Hardware-Software Synergy: Under Norio Ohga, Sony acquired CBS Records (1988) and Columbia Pictures (1989). They weren’t just a tech company anymore; they were a Hollywood powerhouse.

The PlayStation & The Digital Struggle (1994–2011)

Nintendo famously backed out of a partnership with Sony for a CD-ROM add-on. Sony decided to release the console themselves, a move that would eventually save the company.

The PlayStation (1994): It disrupted the gaming industry and made Sony the king of the living room.

The “Sony Shock”: In the early 2000s, Sony struggled with the transition to the internet era. Apple’s iPod killed the Walkman, and Samsung began to dominate the TV market.

The PlayStation Network Hack (2011): A massive security breach exposed 77 million accounts, marking a low point for the brand’s digital reputation.

The One Sony Rebirth (2012–Present)

Under CEOs Kaz Hirai and later Kenichiro Yoshida, Sony underwent a massive restructuring dubbed “One Sony.”

Focus on Sensors: Sony pivoted to become the world leader in Image Sensors. Even if you use an iPhone, you’re using Sony technology.

Entertainment First: They sold off the VAIO laptop division and focused on the Power Trio: Gaming (PS5), Music, and Pictures.

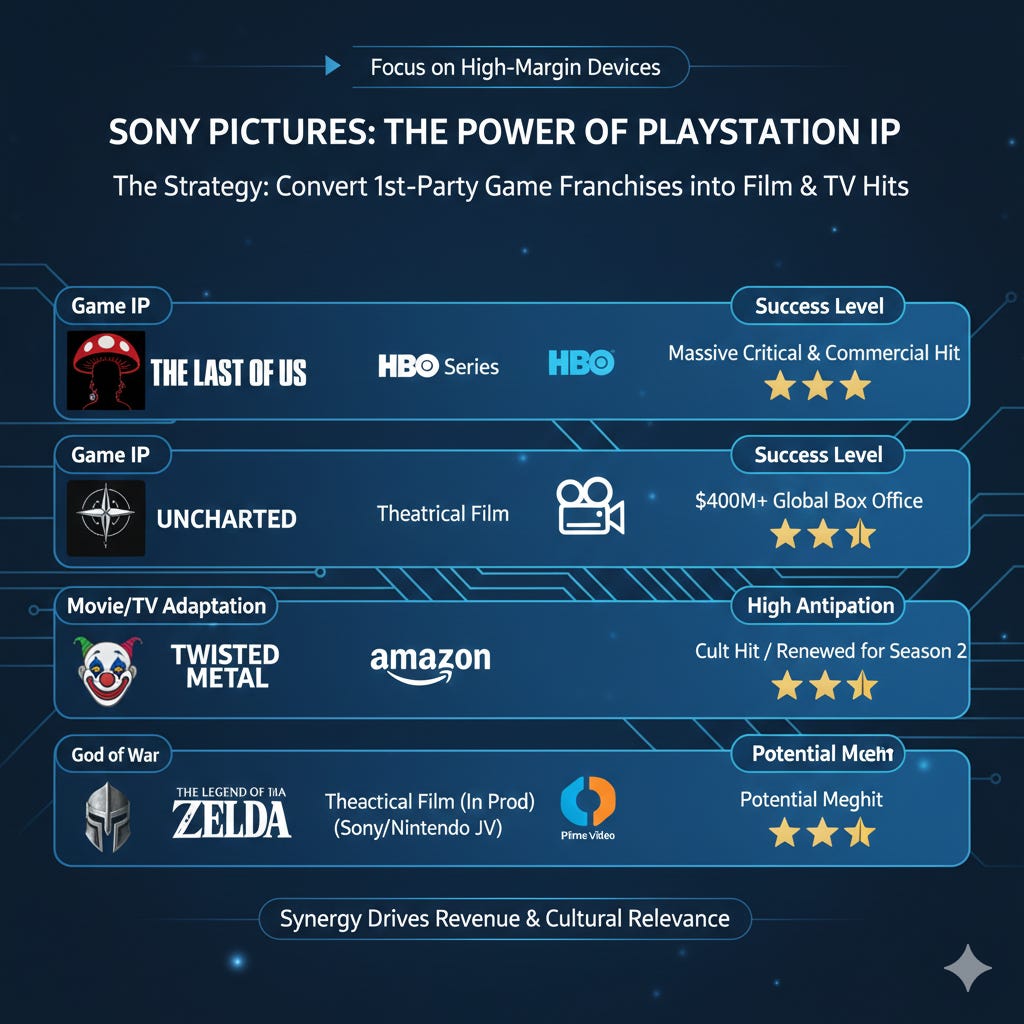

The Future (2020s): Sony is now pushing into Electric Vehicles (AFEELA) through a joint venture with Honda and expanding its IP into movies/TV (e.g., The Last of Us on HBO).

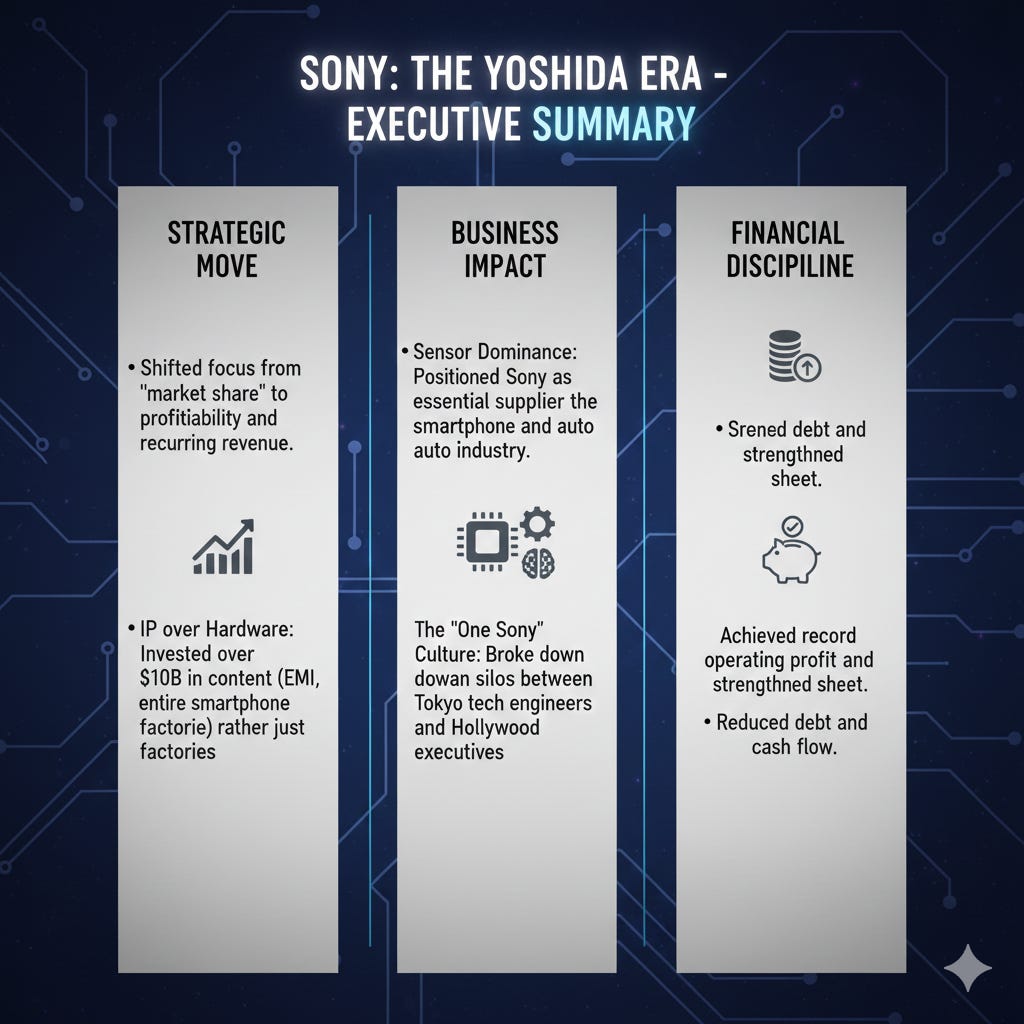

Kenichiro Yoshida is often described as the “architect of the modern Sony.” While his predecessor, Kazuo Hirai, saved Sony from the brink of collapse, Yoshida is the one who turned it into a high-margin, content-driven powerhouse.

The Ice-Cold CFO (2013–2018)

Before becoming CEO, Yoshida served as CFO. He gained a reputation for being a no-nonsense executive who wasn’t afraid to cut ties with Sony’s nostalgic but loss-making heritage.

The VAIO Exit: He was the primary driver behind selling off the iconic VAIO PC division in 2014. For many within Sony, this was a shock, but Yoshida viewed it as a necessary amputation to save the rest of the body.

The TV Spin-off: He orchestrated the spinning off of the TV division into a separate subsidiary, forcing it to be profitable on its own merits rather than relying on Group subsidies.

Pragmatic Realism: Unlike previous leaders who often provided “rosy” forecasts, Yoshida became known for his conservative and realistic financial projections, which rebuilt investor trust after years of missed targets.

Defining Sony’s Purpose (2018–2025)

Upon becoming CEO in 2018, Yoshida shifted the company’s internal philosophy. He introduced a formal Purpose Statement that now guides every division:

“To fill the world with emotion (Kando), through the power of creativity and technology.”

This wasn’t just corporate jargon; it signaled a massive shift from hardware to intellectual property (IP). He moved Sony away from fighting “commodity wars” (selling gadgets at thin margins) and toward owning the content people consume on those gadgets.

The Creative Entertainment Strategy

Yoshida’s strategy revolves around three distinct layers that feed into each other:

Content (Music, Movies, Gaming): He spent billions to bolster Sony’s library. A key example was the $2.3 billion acquisition of EMI Music Publishing in 2018, making Sony the world’s largest music publisher.

DTC (Direct-to-Consumer): Instead of building a “Netflix killer” (which he saw as too expensive), he focused on communities of interest. This led to the $1.17 billion acquisition of Crunchyroll, turning Sony into the global king of anime.

Synergy (The “Last of Us” Model): He championed the idea of One Sony, where a PlayStation game becomes a hit HBO show, the soundtrack is handled by Sony Music, and the cinematography is shot on Sony Venice cameras.

The CMOS Sensor Pivot

While Sony is famous for the PlayStation, Yoshida recognized that Sony’s most valuable tech was actually invisible. He doubled down on Image Sensors (I&SS).

Sony now owns roughly 50% of the global image sensor market.

Yoshida’s bet was that even if people stopped buying Sony phones, they would still buy iPhones—and every iPhone needs Sony sensors. This turned a consumer risk into a business-to-business (B2B) certainty.

Mobility and the Future (AFEELA)

Under Yoshida, Sony made the shocking move into the automotive space. He views the car not as a vehicle, but as a “moving entertainment space.”

He formed Sony Honda Mobility to create the AFEELA brand.

The logic: When cars become autonomous, the “driver” becomes a “passenger” with hours of free time—time they can spend consuming Sony music, movies, and games.

If Kenichiro Yoshida was the Architect of Sony’s revival, Hiroki Totoki is the Operator tasked with scaling it.

Having officially taken the reins as CEO on April 1, 2025, Totoki represents a continuity leadership style. He isn’t there to fix a broken company; he is there to optimize a successful one.

The Right-Hand Succession

The transition from Yoshida to Totoki was one of the most stable successions in Japanese corporate history.

The Partnership: For over a decade, Totoki was Yoshida’s closest confidant. While Yoshida set the high-level strategy (IP over Hardware), Totoki was the CFO/COO who actually executed the numbers.

The Dual Mandate: Uniquely, Totoki served as President, COO, and CFO simultaneously during the transition period. This gave him an unprecedented 360-degree view of the company’s plumbing before he ever took the CEO title.

Creative Entertainment Vision (2025–2035)

While Yoshida’s era was about acquiring IP (buying EMI, Crunchyroll, etc.), Totoki’s era is about “IP 360”—the seamless integration of that IP across all mediums.

His 10-year roadmap, titled the Creative Entertainment Vision, focuses on three pillars:

IP Creation: Investing in original stories (like Ghost of Yōtei or new music talent).

IP Cultivation: Growing niche communities (turning Crunchyroll from a streaming site into a global lifestyle brand for anime fans).

IP Extension: Taking a single piece of IP and moving it across gaming, film, and music simultaneously to maximize “lifetime value.”

The Boundary Spanners Philosophy

A key term Totoki uses in his strategy meetings is “Boundary Spanners.” In the past, Sony’s divisions (Sony Pictures, Sony Music, PlayStation) operated like separate kingdoms that rarely spoke. Totoki is obsessed with breaking these silos. He wants boundary-spanning employees who ensure that the PlayStation team is working with the Pictures team from day one of a project.

The “One Sony” Metric: Totoki is shifting the focus from individual division profits to “Group Synergies.” He wants to see how much a successful game launch like The Last of Us drives sales in Sony Music (soundtracks) and Sony Pictures (TV series).

Addressing the PlayStation Friction

Totoki hasn’t been afraid to be critical. In 2024, while serving as Interim CEO of Sony Interactive Entertainment (PlayStation), he made waves by publicly stating that the gaming division needed to improve its business margins.

His Critique: He noted that while PlayStation creates great games, they weren’t disciplined enough about development costs and schedules.

The Shift: Under his leadership, expect a more “multi-platform” approach. He is pushing for PlayStation first-party titles to arrive on PC sooner to recoup high development costs, a controversial but financially pragmatic move.

As of January 2026, the PlayStation business, formally the Games & Network Services (G&NS) segment, is Sony’s primary profit engine. The division has successfully transitioned into a highly profitable state following the early PS5 launch phase, reaching record-breaking operating income.

Financial Performance and Hardware Status

The business has seen a significant surge in profitability, with recent quarterly reports showing a 127% increase in operating profit to $1 billion. This success is primarily attributed to high-margin software sales and network services rather than hardware volume alone.

While hardware sales remain steady, Sony has shifted focus toward premium hardware to maintain margins and appeal to enthusiasts.

PlayStation 5 Pro: The latest mid-generation refresh features AI-driven upscaling (PSSR), 2TB of storage, and advanced ray tracing to provide a higher-end experience for core gamers.

PlayStation VR2: This headset continues to serve as a niche, premium accessory with 4K HDR visuals and eye-tracking technology, though its growth is slower compared to the main console ecosystem.

PlayStation Portal: A successful expansion into remote play, this device has recently been updated to support cloud streaming for PlayStation Plus Premium members, reducing its total dependency on the console.

Strategic Shifts: Live Services and Multi-Platform

Sony is currently navigating a complex transformation in its content strategy. Management has admitted to “many issues” in their live service roadmap, highlighted by the high-profile failure of titles like Concord. However, they remain committed to a hybrid approach:

Sustainable Live Services: Successes like Helldivers 2 provide stable, recurring revenue. Sony aims to refine this pipeline to reduce waste and focus on long-term engagement.

Narrative Single-Player Focus: Despite the push for live services, Sony has reaffirmed its commitment to the “highly narrative-driven” single-player games that built the brand’s reputation.

Expanded Reach: The “multi-platform” strategy is becoming more defined. Multiplayer titles are increasingly launching day-and-date on PC, while flagship single-player exclusives typically arrive on PC after a period of timed exclusivity to maximize console hardware sales first.

Sony’s transition from a hardware-reliant company to a Service and Software giant is best seen through the lens of PlayStation Plus (PS Plus) and the PlayStation Store.

As of 2026, these two components represent the vast majority of the division’s $30B+ annual revenue, moving Sony away from the volatile hit-driven console cycles of the past.

The PlayStation Plus Ecosystem

In 2026, PS Plus has finalized its shift toward a next-gen-centric model. Sony has officially pivoted away from offering new PS4 games as a primary benefit, focusing almost entirely on the PS5 library to encourage console migration.

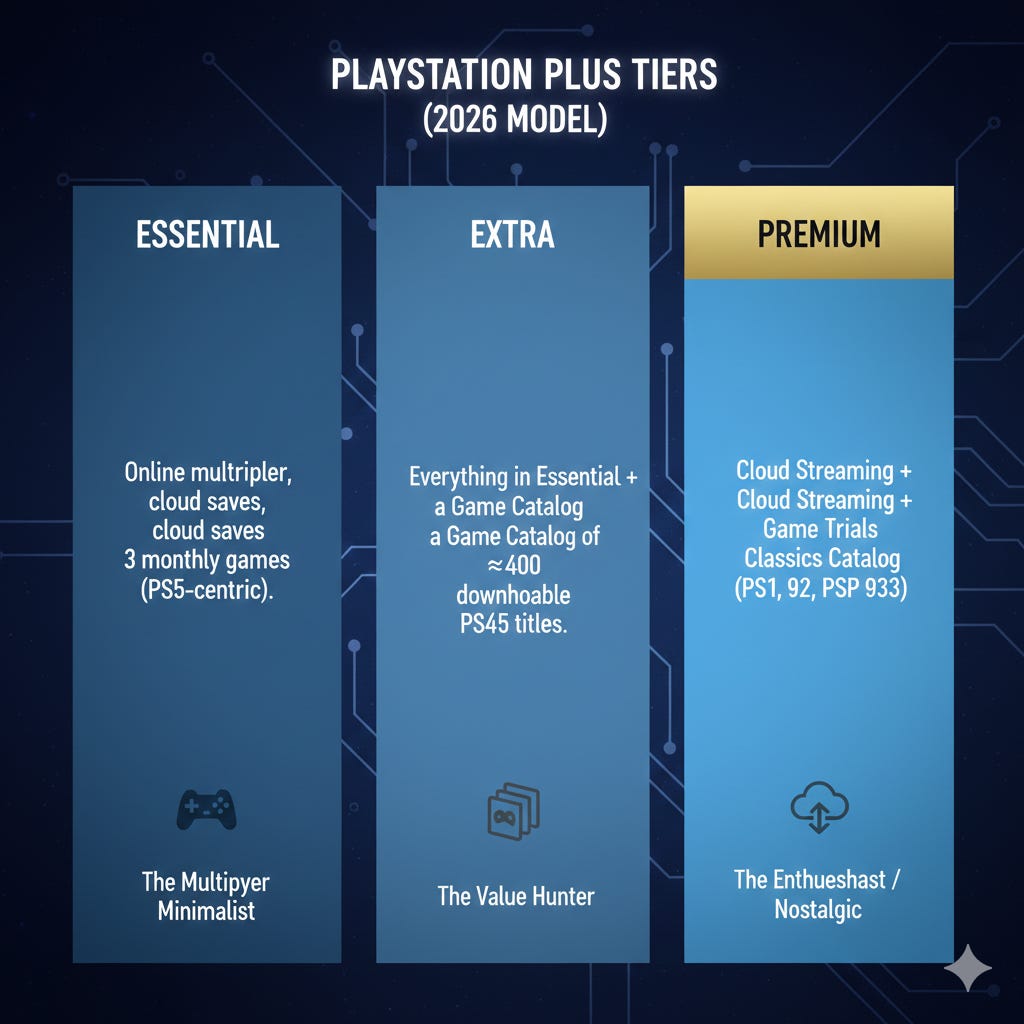

The Three-Tier Strategy

Sony uses a “Good-Better-Best” pricing model to segment its 50 million+ subscribers and increase Average Revenue Per User (ARPU).

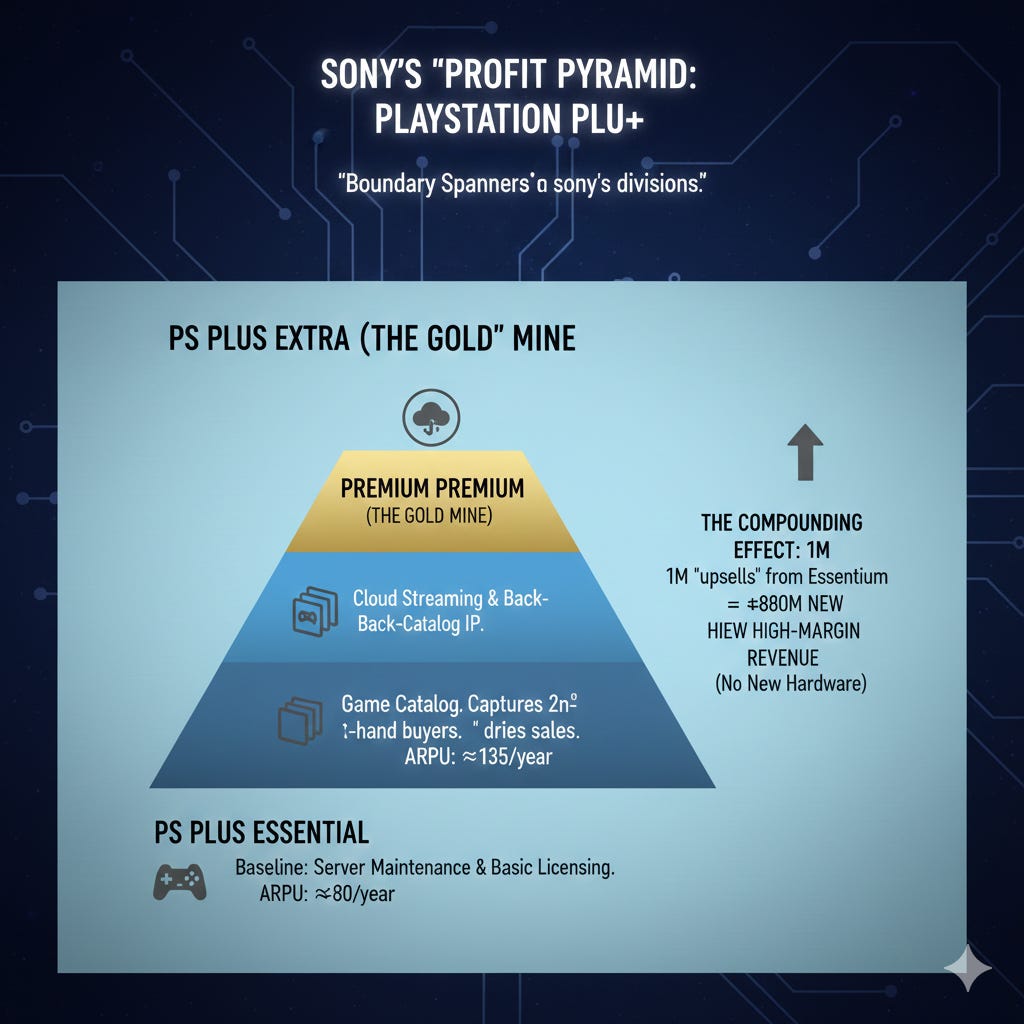

The Profit Pyramid: PS Plus Tiers

Since the 2022 revamp and subsequent 2024–2025 price adjustments, the gap in revenue generation between tiers has widened significantly.

PS Plus Essential: This is the “baseline.” It covers the cost of server maintenance and basic licensing. The ARPU here is roughly $80/year.

PS Plus Extra: By adding the “Game Catalog,” Sony captures users who might have otherwise bought 1–2 used games (where Sony gets $0). Here, the ARPU jumps to roughly $135/year.

PS Plus Premium: This is the high-margin “Gold Mine.” By leveraging cloud streaming and back-catalog IP (which has already been paid for years ago), Sony sees an ARPU of roughly $160/year.

The Compounding Effect: For every 1 million users Totoki can upsell from Essential to Premium, Sony adds approximately $80 million in high-margin revenue without needing to manufacture a single piece of hardware.

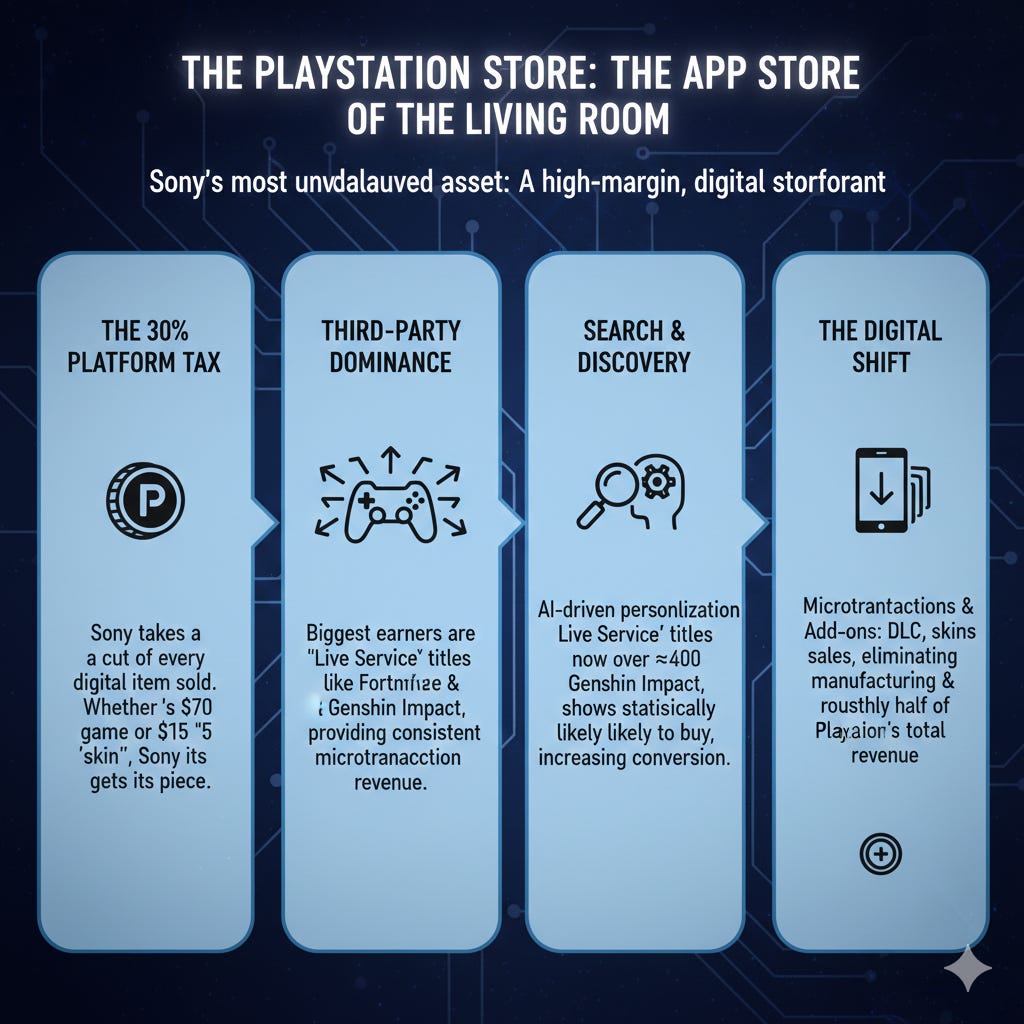

The PlayStation Store: The App Store of the Living Room

The PlayStation Store is Sony’s most undervalued asset in many financial circles. It functions exactly like the Apple App Store, but with a more captive audience.

The 30% Platform Tax: Sony takes a cut of every digital item sold. Whether it’s a $70 blockbuster or a $5 “skin” in Fortnite, Sony gets its piece.

Third-Party Dominance: Interestingly, the biggest earners on the PS Store aren’t always Sony’s own games. Massive “Live Service” titles like Genshin Impact, Fortnite, and Call of Duty provide a consistent stream of microtransaction revenue that flows to Sony year-round.

Search and Discovery: Under Totoki, the store has used more AI-driven personalization (similar to Netflix) to show users games they are statistically likely to buy, increasing the “conversion rate” of casual browsers into buyers.

The Digital Shift: Digital downloads now account for over 80% of all full-game sales. This eliminates manufacturing, shipping, and retail-partner costs, making this a win-win for game developers and Sony.

Microtransactions & Add-ons: Is the secret sauce of the store. Digital add-on content (DLC, skins, and virtual currency) now accounts for roughly half of PlayStation’s total revenue.

The Mobile & Web Expansion

A major part of the current strategy is making the store accessible outside the console.

The PlayStation App: The mobile app serves as the primary storefront for many users. It allows for remote downloads, where a user can buy a game on their phone while at work and have it ready to play when they get home.

Unified Identity: By tying the store, social features, and subscriptions into a single PSN ID, Sony creates high switching costs. If a user has a 10-year-old library of digital games and a Premium sub, they are statistically unlikely to switch to a competitor.

The Sony Music Group (SMG) segment is arguably the most stable and pure compounding engine within Sony’s portfolio. While PlayStation in the past was susceptible to expensive hardware cycles, music thrives on high-margin, recurring revenue driven by the global explosion of streaming.

As of 2026, SMG consists of two primary powerhouses: Recorded Music (Sony Music Entertainment) and Music Publishing (Sony Music Publishing).

The Financial Engine: Streaming & High Margins

Sony Music has seen consistent double-digit growth, with operating income recently surging as the industry matures.

Streaming Dominance: Approximately 70% of Recorded Music revenue now comes from streaming services like Spotify and Apple Music. This is passive income for Sony—they own the master recordings and collect checks every time a song is played.

The Publishing Powerhouse: Sony is the world’s largest music publisher. Following the EMI acquisition (orchestrated by Yoshida), they own or administer over 5 million songs, including legends like The Beatles, Queen, and Michael Jackson, alongside modern stars like Taylor Swift and Beyoncé.

Operating Margins: The Music segment often boasts operating margins in the 18-20% range, significantly higher than the hardware-heavy electronics divisions.

Strategic Moats: The Catalog Wars

Under Hiroki Totoki’s “IP 360” vision, Sony has been the most aggressive player in the Catalog War, buying up the rights to iconic artists to ensure long-term cash flow.

The Queen Acquisition (2024/2025): In one of the largest deals in history, Sony acquired Queen’s catalog for roughly $1.27 billion. This includes hits like Bohemian Rhapsody, which generate massive licensing fees from movies, commercials, and streaming.

The Pink Floyd Deal: Sony recently closed a deal for Pink Floyd’s recorded music rights and name/likeness for approximately $400 million, further solidifying their grip on “Classic Rock” revenue.

Niche Consolidation: Sony Music Nashville recently acquired Big Yellow Dog Music (January 2026), showing that they are still aggressively tucking in smaller publishers to maintain dominance in specific genres like Country.

IP 360 and Synergy

Sony Music is no longer a silo. It is now deeply integrated with the rest of the One Sony ecosystem:

Gaming Integration: Sony Music artists are increasingly integrated into PlayStation titles (e.g., custom soundtracks and in-game concerts).

Film & TV: Sony Music Publishing provides the library for Sony Pictures’ soundtracks, keeping the licensing fees “in the family.”

Anime (Crunchyroll): Sony uses its music division to produce and distribute soundtracks for hit anime series, which is one of the fastest-growing music sub-genres globally.

Sony Pictures Entertainment (SPE) is particularly fascinating. While other studios like Disney and Warner Bros. Discovery have bled billions trying to build “Netflix killers,” Sony has taken the opposite path.

Sony operates as the Arms Dealer of the streaming wars. They don’t care who wins the war; they just want to sell the bullets (content) to everyone.

The Arms Dealer Strategy

Sony is the only major legacy studio without its own general-interest streaming service. This creates a massive competitive advantage:

Selling to the Highest Bidder: Instead of locking their movies (like Spider-Man or Bad Boys) behind a Sony-branded wall, they auction them off.

The Netflix Pay-1 Deal: Sony recently extended and expanded its massive Pay-1 deal with Netflix. Starting in late 2026/2027, Netflix will remain the exclusive home for Sony’s theatrical films after their cinema runs. This deal is worth billions and provides high-margin, guaranteed revenue before a single frame of a movie is even shot.

The Disney Backstop: After the initial 18-month window on Netflix, the rights often flow to Disney (for Marvel-related IP like Spider-Man). Sony essentially gets paid twice for the same movie.

Crunchyroll: The Niche King Exception

While Sony avoids general streaming, they are obsessed with community-based streaming. Crunchyroll is the crown jewel of this strategy.

Massive Scale: As of August 2024, Crunchyroll surpassed 15 million monthly paid subscribers. It is one of the few profitable streaming services in existence outside of Netflix.

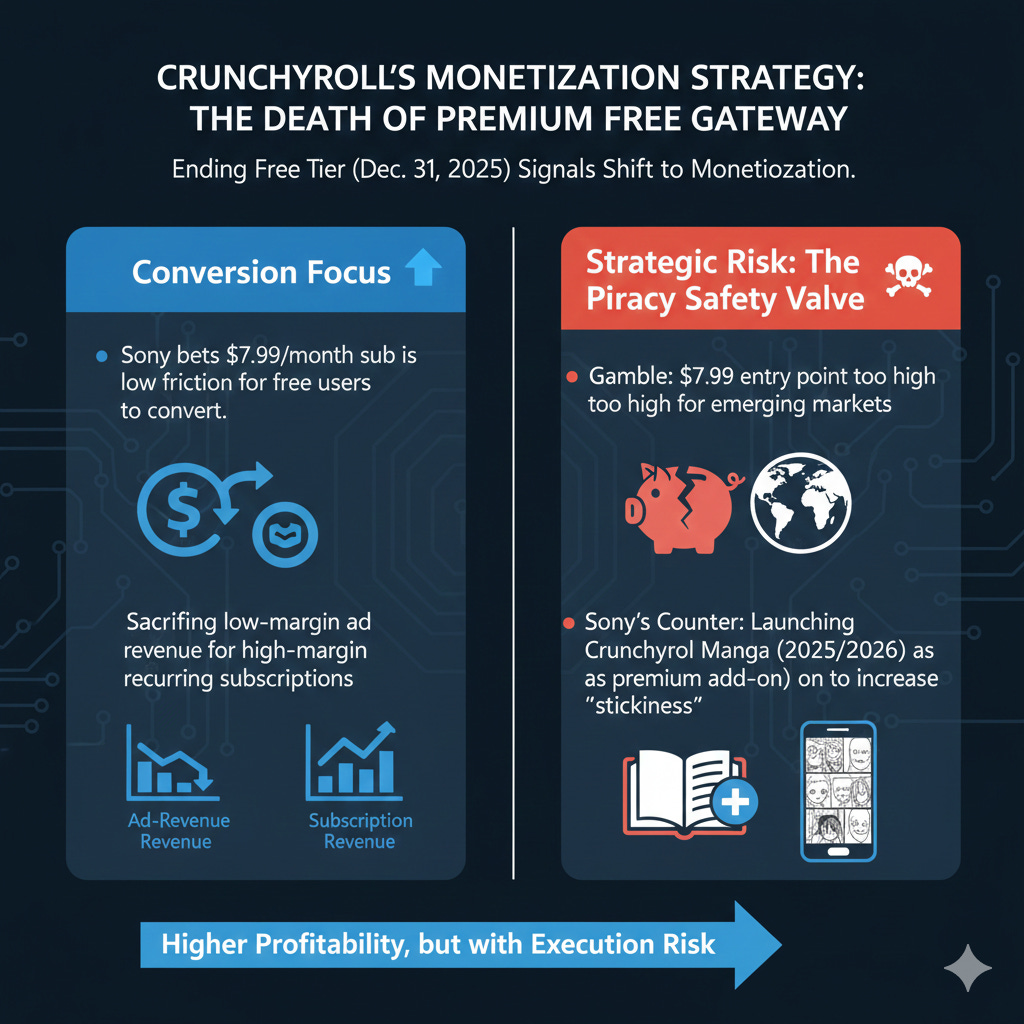

Ending the Free Era: Starting January 1, 2026, Crunchyroll has officially moved to a mandatory paid model, ending its long-standing free ad-supported tier. This is a bold move to maximize ARPU (Average Revenue Per User) and convert its massive global audience into a recurring cash engine.

Monetizing the Fandom: Crunchyroll isn’t just a video site; it’s a platform for games, merchandise, and theatrical events (like the Demon Slayer or Jujutsu Kaisen movies). It is a perfect example of Yoshida’s “IP Cultivation” strategy.

IP 360 in Action: Gaming to Screen

Sony Pictures is now the primary vehicle for turning PlayStation IP into mass-market hits. This “flywheel” effect is what Totoki calls IP 360.

Financial Outlook: Efficiency Over Size

Operating Margins: By avoiding the $2B–$3B annual marketing and tech spend required to maintain a platform like Disney+, Sony Pictures maintains much cleaner margins.

Risk Mitigation: Because they license content to Netflix/Disney, they offload the “risk” of a movie flopping on a streaming platform to the licensee.

While Sony does not always break out Crunchyroll’s exact net profit margin as a standalone line item in every quarterly report, we can derive its impact using Sony’s Pictures segment data and management’s commentary on “Media Networks.”

As of late 2025/early 2026, Crunchyroll has become the primary driver of margin expansion for the entire Pictures division.

Crunchyroll’s Estimated Profit Contribution

Here is the financial breakdown of how Crunchyroll moves the needle for Sony Pictures:

Operating Margin Premium: While the traditional “Motion Pictures” (movie studio) segment fluctuates based on box office hits, the “Media Networks” sub-segment (anchored by Crunchyroll) typically operates at a 20-25% operating margin. This is significantly higher than the 8-10% margins often seen in theatrical distribution.

Contribution to Segment Profit: Crunchyroll now accounts for an estimated 35-40% of Sony Pictures’ total operating income, despite representing a smaller fraction of total revenue.

Revenue Per User (ARPU): With 15 million+ subscribers paying an average of $10-$15/month, Crunchyroll generates approximately $1.8B - $2.2B in high-margin recurring revenue annually.

The Death of the Free Gateway

For years, Crunchyroll used a freemium model to compete with piracy. By ending the free ad-supported tier on December 31, 2025, Sony has officially signaled that the land grab phase is over and the monetization phase has begun.

Conversion Focus: Sony is betting that the friction of a $7.99/month sub is low enough that a significant portion of their tens of millions of free users will convert rather than resort to piracy.

Ad-Revenue Trade-off: The platform is sacrificing broad, low-margin ad revenue for consistent, high-margin recurring subscription revenue. This makes the segment’s cash flow much more predictable for analysts.

Strategic Risk: The Piracy Safety Valve

The biggest risk is the resurgence of piracy. Anime has a long history of unofficial streaming sites.

The Gamble: If the $7.99 entry point is too high for emerging markets (like Southeast Asia or Latin America), Sony risks pushing a generation of fans back to illegal sites.

Sony’s Counter: To mitigate this, Sony is launching Crunchyroll Manga (2025/2026) as a premium add-on to increase the stickiness of the subscription. They are trying to make the app a lifestyle utility rather than just a video player.

The Imaging & Sensing Solutions (I&SS) segment is Sony’s silent monopoly. While the PlayStation is the face of the company, I&SS provides a critical component that the rest of the tech world—including rivals like Apple and Samsung—cannot live without.

As of 2026, I&SS has moved from being a simple component supplier to a high-margin semiconductor powerhouse.

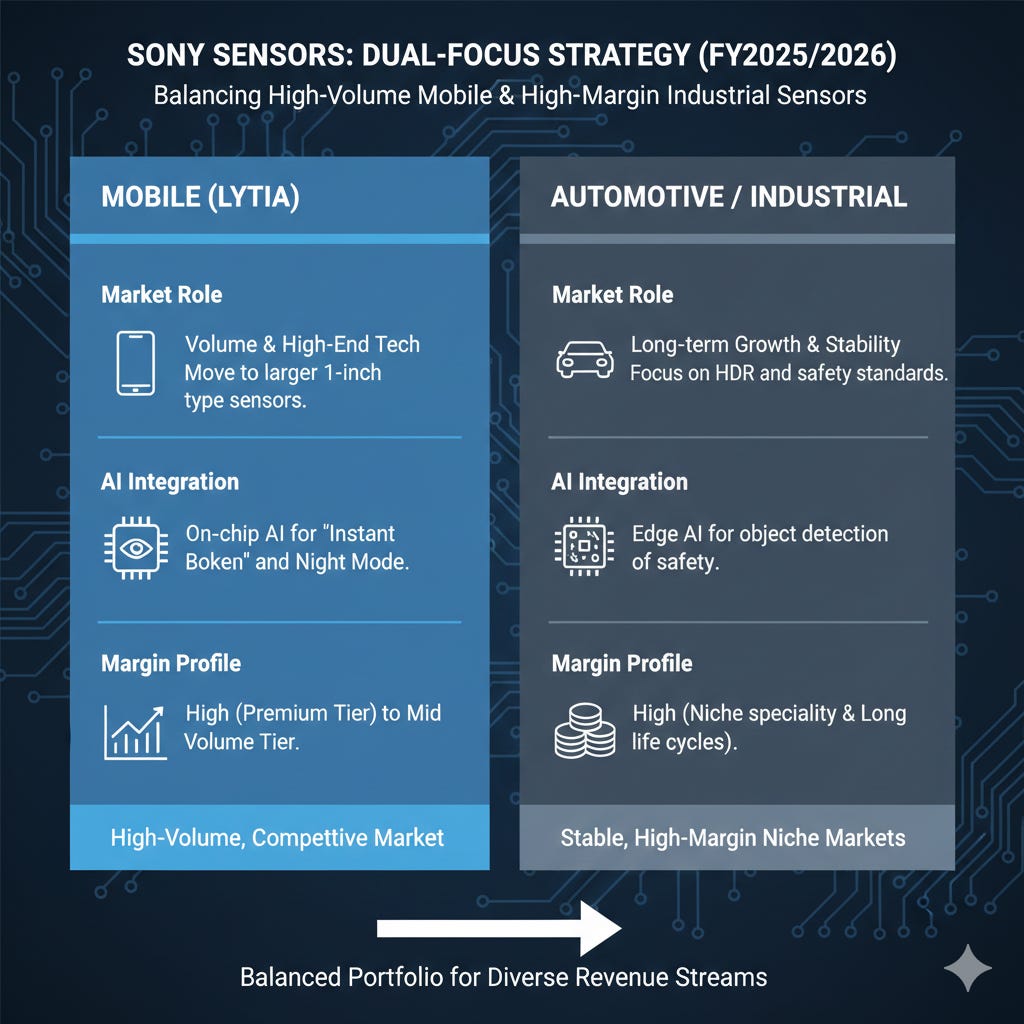

Market Dominance: The 50% Goal

Sony remains the undisputed king of the image sensor world.

Current Market Share: Sony currently holds over 51% of the smartphone image sensor market (as of Q2 2025 data).

Target: Management’s long-term goal has been to secure 60% of the total market share by FY2030.

The Lytia Brand: Sony has successfully transitioned its mobile sensors under the consumer-facing brand LYTIA, making the “Sony sensor” a premium marketing feature for smartphone manufacturers, much like “Intel Inside” once was for PCs.

Financial Performance (FY2025/2026)

The I&SS segment is currently seeing record-breaking results due to a shift toward larger, higher-margin sensors in premium smartphones.

Operating Income Surge: In the most recent quarterly reports (Q2 FY2025), I&SS operating income grew by 50% year-on-year.

Revenue Forecast: Sony upwardly revised its full-year sales forecast for the segment to ¥1.99 trillion ($13.5B+), driven by higher unit prices and an increase in sales volume for high-end mobile devices.

Profitability: The segment is targeting an operating margin of roughly 15-16%, a significant recovery from previous years where high R&D and capital expenditure (CapEx) for new factories squeezed the bottom line.

The AI Sensor

Built-in AI: Sony recently released the world’s first 200-megapixel mobile sensor with built-in AI technology. Instead of sending raw data to a phone’s processor (which is slow and power-hungry), the sensor itself processes the image data.

AITRIOS™ Platform: This is Sony’s B2B edge AI sensing platform. It’s used in retail (tracking foot traffic), logistics (scanning packages), and industrial automation. This shifts Sony from selling “chips” to selling “solutions” (hardware + software).

Diversification Beyond Mobile

To de-risk the business from the maturing smartphone market, Sony is aggressively expanding into two high-growth areas:

Automotive (ADAS): Sony is the leader in sensors for Advanced Driver Assistance Systems. Modern cars now use 10+ cameras; Sony is positioning itself to be the eyes of the autonomous vehicle revolution.

Industrial & Security: Global shutter sensors for high-speed factory automation and advanced sensors for security cameras are providing a steady, non-consumer-reliant revenue stream.

The One Sony Symphony and the Forward

The individual segments of Sony—Gaming, Music, Pictures, and Sensing—are no longer disparate businesses; they are the specialized instruments of a single, coordinated orchestra. Under the One Sony narrative, the company has successfully moved past the electronics-first identity of the 20th century to become the world’s first true Creative Entertainment Conglomerate.

The IP 360 Flywheel

The core of Sony’s future is the Creative Entertainment Vision (2025–2035). This isn’t just about owning content; it’s about the velocity of IP. Hiroki Totoki’s strategy ensures that a single piece of intellectual property can be monetized across every conceivable touchpoint:

A PlayStation game becomes a Sony Pictures cinematic event.

The soundtrack is dominated by Sony Music artists.

The experience is captured and shared via LYTIA sensors.

The community is fostered year-round on Crunchyroll.

By acting as Boundary Spanners, Sony’s divisions are breaking down the silos that once plagued the company, creating a high-margin ecosystem that is remarkably difficult for competitors to replicate.

The Future: Mobility and Beyond

Looking ahead, Sony’s ambitions extend into the physical world through Mobility and AI.

Sony Honda Mobility (AFEELA): As vehicles transition into “software-defined” spaces, Sony is positioning the car as the next great entertainment hub. With production slated to ramp up toward 2026, the AFEELA brand represents the ultimate integration of Sony’s sensing tech, gaming interfaces, and media libraries.

The AI Layer: By embedding AI directly into its sensors and using machine learning to personalize the PlayStation Store, Sony is ensuring that its One Sony ecosystem is not just vast, but intelligent and hyper-efficient.

Sony has successfully de-risked its business model. It has traded the volatility of hardware cycles for the compounding power of global IP.

With Hiroki Totoki at the helm and Kenichiro Yoshida providing strategic oversight as Chairman, Sony is entering 2026 not as a tech company not just trying to entertain, but as an entertainment giant that owns the technology. This is a business built for high-margin, recurring cash flow and long-term dominance.

Revenue and Growth: The Breakout Era

Sony’s revenue chart shows a distinct shift from stagnant growth to a powerful breakout starting in 2021.

Top-Line Acceleration: After hovering between $40B and $50B for nearly a decade, revenue surged to over $80B (TTM) by Q2 2025.

Recent Momentum: The 2-year revenue growth stands at 20.09%, signaling that the One Sony ecosystem (Gaming, Music, and Sensors) is finally firing on all cylinders simultaneously.

Structural Quality: Unlike the high-volume/low-margin electronics of the 1990s, this new revenue is driven by recurring software, subscriptions, and high-value B2B sensors.

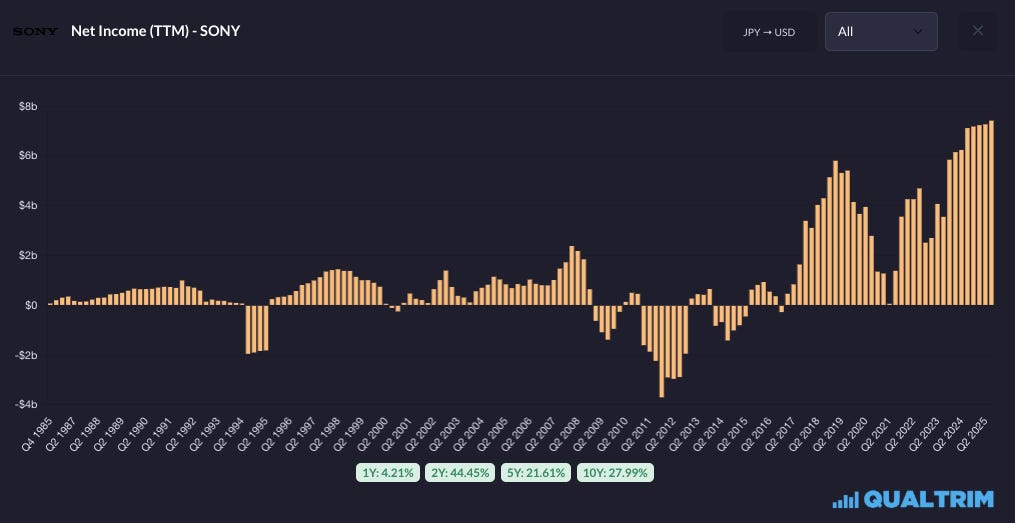

Profitability and Cash Flow: A Quality Transition

The most striking chart is Sony’s Net Income (TTM), which has reached all-time highs of approximately $8B.

Consistent Earnings: For the first time in 40 years, Sony has maintained high profitability for over five consecutive years without the massive “dips” into negative territory seen in the early 2010s.

Free Cash Flow (FCF) Powerhouse: As of Q3 2025, Sony generated a staggering $10.78B in Free Cash Flow (TTM).

Cash Flow Yield: The 1-year FCF growth of 45.87% highlights the efficiency of the “Arms Dealer” model in Pictures and the high-margin nature of the PlayStation Network.

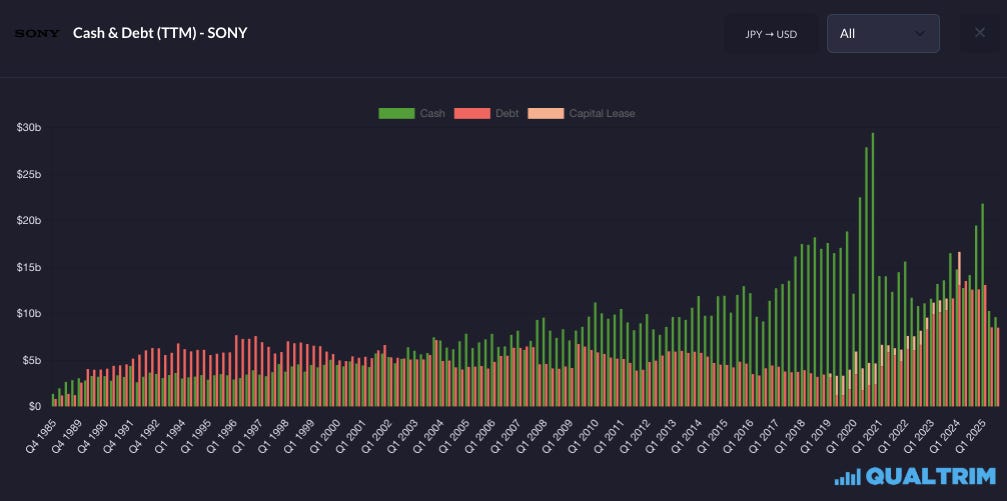

Balance Sheet: Prudent and Liquid

Sony maintains a strong balance sheet that allows for aggressive acquisitions while keeping risk low.

Liquidity Advantage: This high cash position is what allowed Sony to spend over $1B on the Queen catalog and $3.6B on Bungie without stressing the organization.

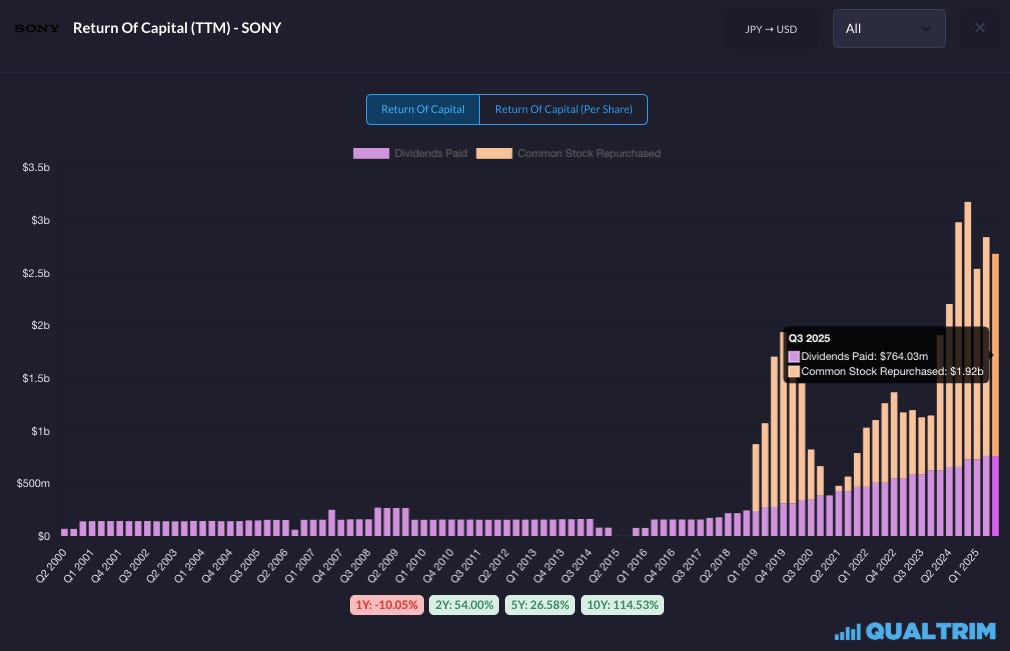

Capital Return: Rewarding Shareholders

Sony is no longer just reinvesting; it is aggressively returning capital to its owners.

Dividends: Sony paid $764.03M in dividends as of Q3 2025, providing a stable, growing base for long-term holders.

Buyback Machine: The Alpha here is the $1.92B in Common Stock Repurchased in the same period.

10-Year Return Trend: The Return of Capital has seen a 114.53% increase over the last 10 years, showing a management team that is highly aligned with shareholders.

Investment Thesis: The One Sony & IP 360 Multiplier

In 2026, the core thesis for Sony is its transition from hardware-centric cycles to high-margin intellectual property (IP) ecosystem. By acting as the Arms Dealer in the streaming wars and the Silent Monopoly in image sensors, Sony has created a unique defensive growth profile.

Platform Dominance: PlayStation has moved from selling consoles to selling a $30B+ recurring service.

Content Scarcity: Sony owns the world’s largest music publishing catalog and a massive anime monopoly via Crunchyroll.

Capital Allocation: Management has shifted toward aggressive share buybacks and high-ROI acquisitions (like Queen’s catalog), signaling a shareholder-first era.

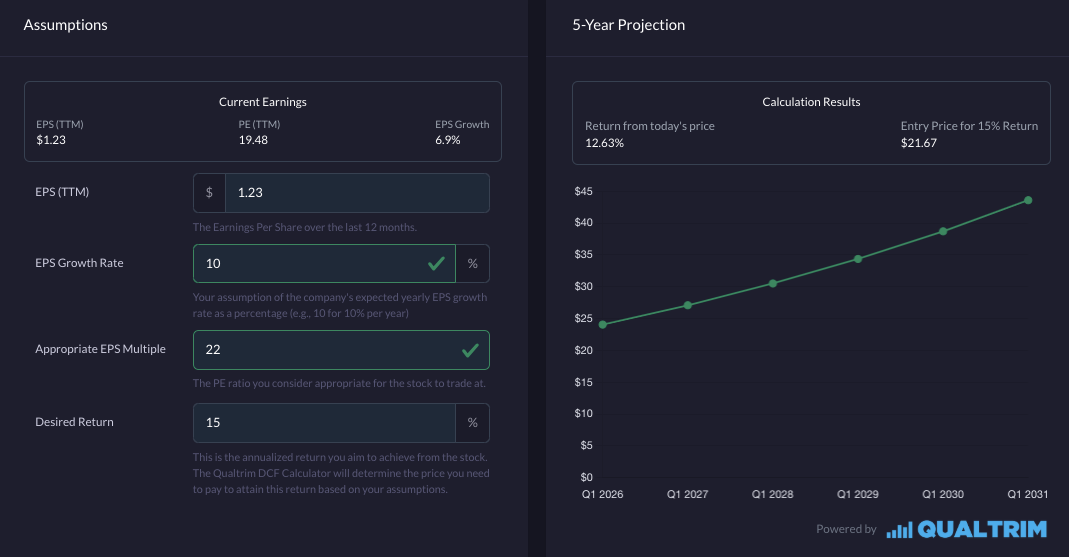

The Base Case: The Steady Compounding Conglomerate

The Scenario: PlayStation margins stabilize at 16% as development costs are reined in by Totoki. The Music segment continues 10% annual growth driven by global streaming price hikes. Image Sensors maintain 50%+ market share but face standard cyclical headwinds in the smartphone market.

Financial Impact: Revenue grows at a mid to high single-digit pace, while EPS grows at double digits due to continued share buybacks, and operating efficiency.

For the base case assumptions, I see EPS growing at a 10% CAGR through 2031, driven by modest growth across the entire One Sony ecosystem, without a breakaway star. An expected exit multiple of 22x, generates an expected 5 year IRR of 12.6%.

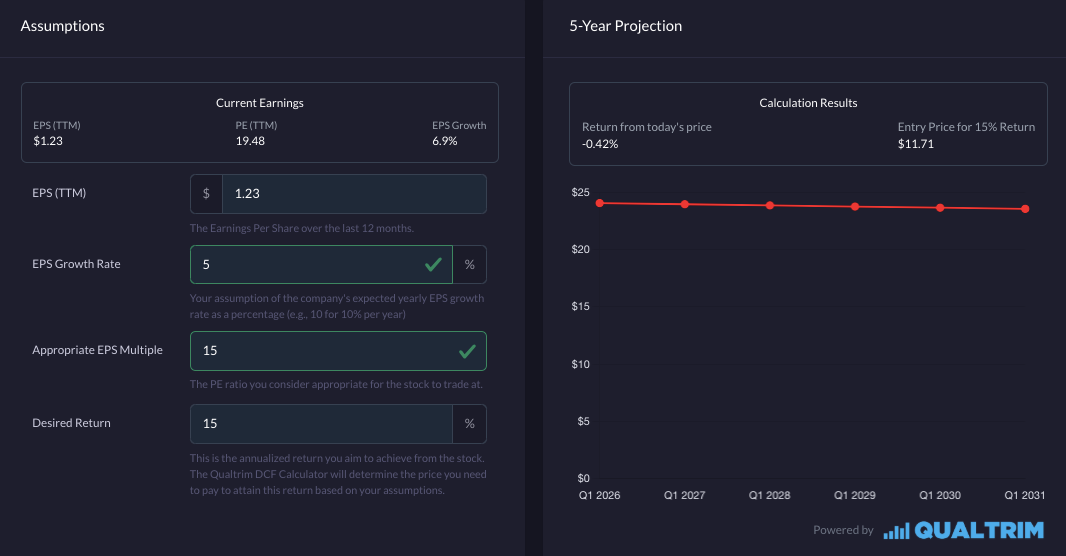

The Bear Case: The Content Fatigue

The Scenario: Piracy eats into Crunchyroll’s new paid model in emerging markets. Live Service games from PlayStation continue to struggle, leading to massive write-downs (similar to the Concord failure). Intensified competition from Chinese sensor manufacturers erodes Sony’s “Lytia” pricing power.

Financial Impact: Operating income stagnates or dips as the Arms Dealer strategy loses leverage with consolidating streamers (e.g., a potential Netflix/Warner merger). The stock continues to trade at a persistent conglomerate discount.

With crunhyroll growth being slowed greatly, so does the overall earrings growth bear case. While Sony will continue to generate solid earnings from its app store and music segments its not enough to overcome difficulties in other key growth areas. In the bear case I have EPS still compounding at 5% per annum and the multiple contracting back to 15x. This leaves us with a projected 5 year IRR of -0.42%.

The Bull Case: The Great Margin Expansion

The Scenario: Sony successfully executes the IP 360 vision. Crunchyroll‘s mandatory paid model exceeds 25M subscribers with minimal churn. The PS5 Pro leads to record-breaking ARPU.

Financial Impact: Operating margins expand toward 18-20% across the entire group. Free Cash Flow (FCF) consistently tops $12B+, leading to a significant valuation re-rating closer to a software/SaaS company than a hardware conglomerate.

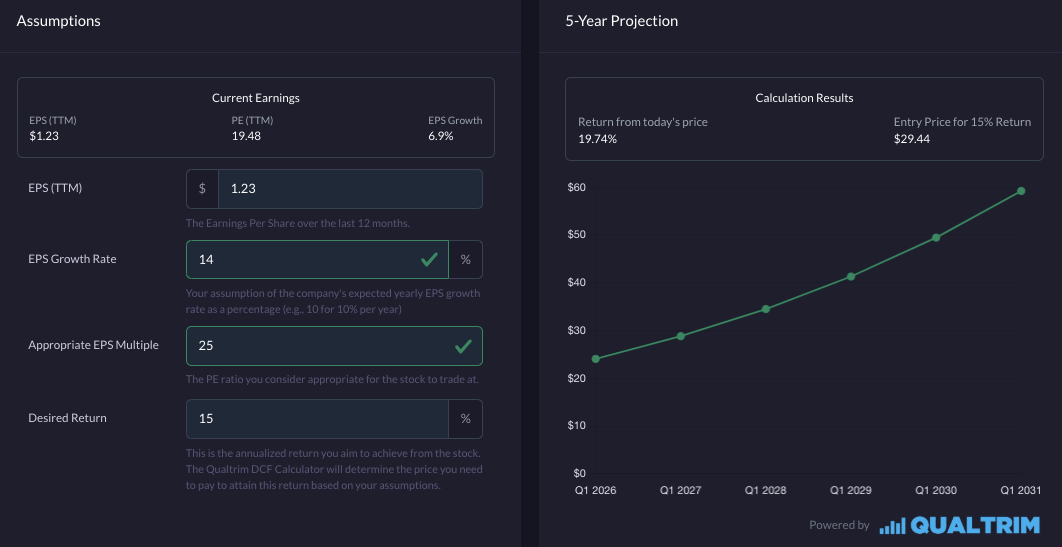

With the IP 360 vision firing on all cylinders, Sony is position nicely in the bull case. With 14% expected EPS growth, driven by a successful launch of paid cruncyroll, along with higher ARPU later in the PS5s lifecycle. With Sony looking less like a hardware conglomerate by the day, in the bull case I model the earnings multiple to reflect that as well. In this scenario, I see the P/E ratio expanding to 25x, delivering a 19.74% 5 year CAGR, or a $59 Sony stock in 2031.

Final Thoughts

As we look toward 2031, Sony’s investment thesis is no longer about the next gadget; it is about the monetization of global intellectual property. Whether through the IP 360 model that turns games into cinematic events or the niche dominance of Crunchyroll, Sony is capturing the lifetime value of the modern consumer. While risks like piracy and hardware development costs remain, the company’s fortress balance sheet and aggressive capital return profile provide a significant margin of safety. If Sony can continue to bridge the gap between world class engineering and creative storytelling, it won’t just be an electronics survivor, it will be the definitive blue-chip compounder for the entertainment age.