GitLab ($GTLB): The Swiss Army Knife Solving the AI Paradox

Why a 119% retention rate, zero debt, and a Single Application moat make this the most critical digital-infrastructure bet of 2026.

The evolution of GitLab from a niche open-source project in 2011 to a public enterprise powerhouse reflects a fundamental shift in how the world builds software. Founded on the radical principles of total transparency and an all-remote workforce, GitLab has successfully transitioned from a simple code repository to a comprehensive Single Application for the entire DevOps lifecycle. As of early 2026, the company stands at a critical strategic inflection point under the new leadership of CEO Bill Staples. By positioning itself as the AI-Powered DevSecOps Platform, GitLab is moving beyond basic code hosting to solve the AI Paradox, the industry-wide challenge where rapid AI code generation creates massive bottlenecks in security and deployment. With a clean, debt-free balance sheet and a dominant position in the high-security Sovereignty market, GitLab is cementing its status as one of the two essential operating systems for the modern enterprise.

Executive Summary

As of early 2026, GitLab ($GTLB) has evolved from a niche open-source project into a mission-critical AI-Native Factory for the modern enterprise. Under the leadership of CEO Bill Staples, the company is successfully pivoting from a simple developer tool to a comprehensive infrastructure platform that solves the AI Paradox, where rapid code generation creates massive bottlenecks in security and operations.

Key Financial & Strategic Pillars:

The Power of One: GitLab’s Single Application architecture allows companies to eliminate the Toolchain Tax, saving roughly 25% in total software costs by replacing fragmented point solutions like Snyk, Jenkins, and Jira.

The Switzerland of DevOps: By maintaining multi-cloud neutrality and supporting self-hosted (air-gapped) environments, GitLab has captured the Sovereignty market, serving 50% of the Fortune 100 who are wary of Microsoft/Azure lock-in.

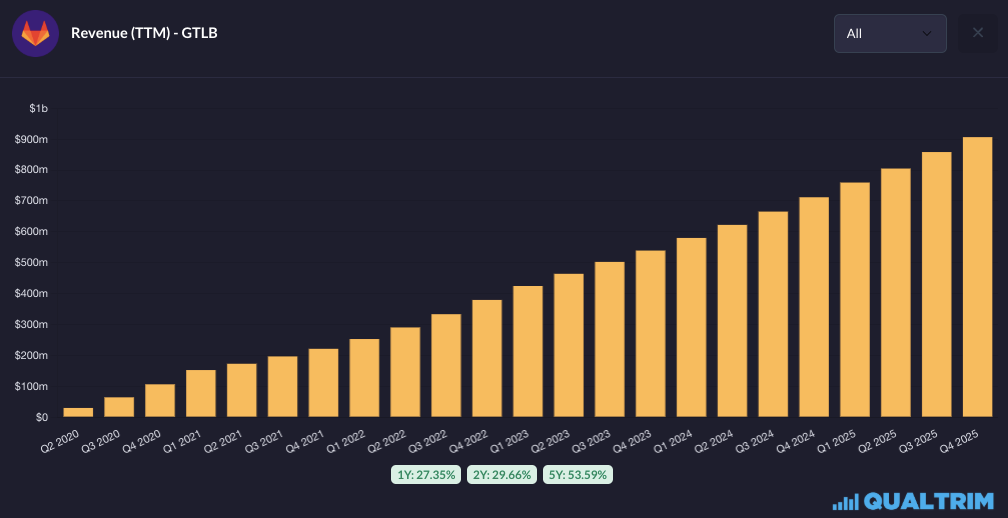

Financial Maturity: The company has reached a critical inflection point, reporting $908.2M in TTM revenue as of Q4 2025 and generating consistent positive non-GAAP free cash flow.

High-Value Tier Migration: The shift toward Agentic AI is driving a massive transition to the Ultimate tier ($99/mo), which now accounts for over 50% of Total ARR.

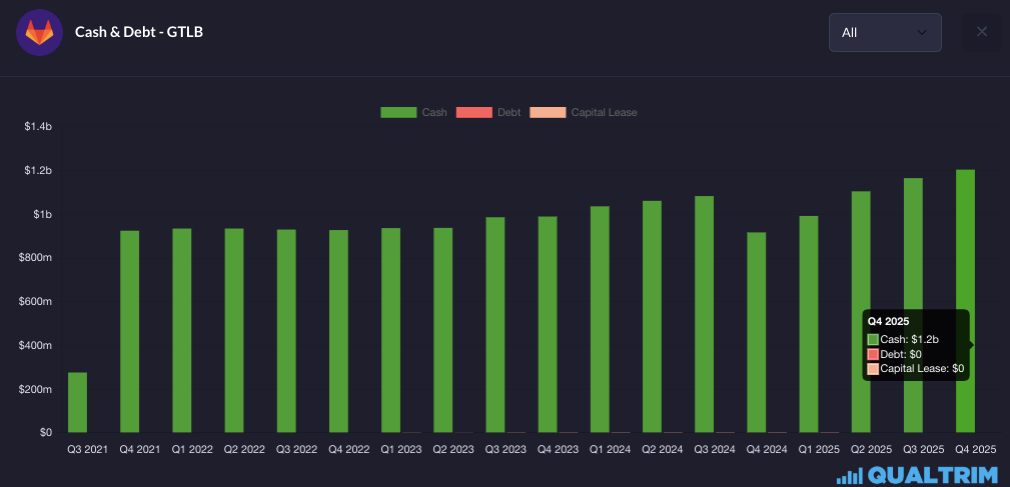

Clean Balance Sheet: With $1.2B in cash and zero debt, GitLab possesses the financial firepower to out-innovate smaller competitors and survive prolonged macroeconomic volatility.

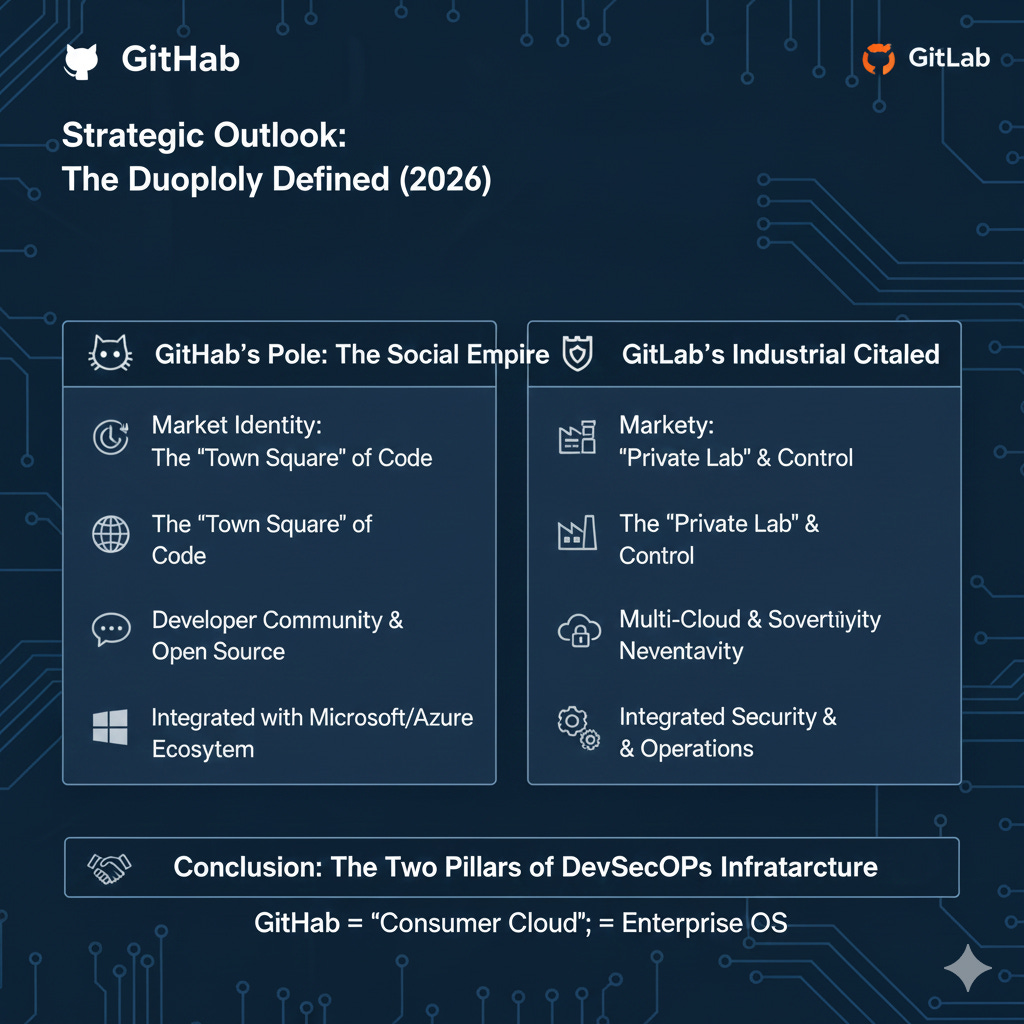

Strategic Outlook: The market has settled into a stable GitHub vs. GitLab duopoly. While GitHub owns the “Social” side of code, GitLab is winning the “Industrial” side. For investors, the thesis rests on GitLab’s ability to remain the independent, secure alternative to Big Tech as DevSecOps becomes the core operating system of every modern business.

The Inception: 2011–2014

GitLab’s story is unique because it began as an open-source project without a formal company.

2011: The First Commit: Ukrainian programmer Dmitriy Zaporozhets created GitLab from his home because he wanted a great tool to collaborate with his team. He felt existing solutions were too expensive or lacked features.

2012: The Partnership: Dutch entrepreneur Sid Sijbrandij saw the project and was impressed. He reached out to Dmitriy, and they began collaborating. While Dmitriy focused on the code, Sid focused on the “Open Core” business model—keeping the base software free while charging for enterprise-grade features.

2014: Official Incorporation: GitLab Inc. was formally incorporated. One of its most defining characteristics was established early on: it would be “All-Remote.” The company has never had a central headquarters, a radical choice that later became their competitive advantage for global talent.

Scaling & The Single Application Pivot

2015: Y Combinator & Funding: GitLab joined the Y Combinator winter batch. This was a turning point, moving the team to San Francisco (temporarily) and securing $1.5 million in seed funding.

2016: The Master Plan: GitLab pivoted from being just a Git repository (like GitHub) to a Single Application for the entire DevOps lifecycle. They began integrating CI/CD (Continuous Integration/Continuous Deployment) directly into the product.

2018: The Microsoft-GitHub Catalyst: When Microsoft acquired GitHub in 2018, GitLab saw a massive influx of users who feared GitHub would lose its independence. This helped GitLab reach “Unicorn” status ($1B+ valuation) after a $100M Series D round.

The IPO: October 2021

GitLab went public on the NASDAQ under the ticker GTLB during the height of the tech boom.

Valuation: It priced its IPO at $77 per share, significantly above its target range, valuing the company at roughly $11 billion.

Culture on Display: In keeping with their radical transparency, GitLab’s IPO prospectus (S-1) was heavily discussed in the tech community, showcasing their public “Handbook”—a 2,000+ page document detailing exactly how the company operates.

Leadership Transition: 2024–2025

The most significant leadership change in GitLab’s history occurred recently, driven by personal health challenges.

Sid Sijbrandij Steps Down (Dec 2024): After 12 years at the helm, Sid Sijbrandij announced he was stepping down as CEO. The primary reason was his health; Sid has been battling osteosarcoma (a form of bone cancer) and needed to focus on his recovery. He remains the Executive Chair of the Board.

The New CEO - Bill Staples: On December 5, 2024, Bill Staples was named the new CEO. Staples is a veteran in the DevOps and software space:

Previously the CEO of New Relic, where he led a successful turnaround and transition to a private company.

Held senior executive roles at Microsoft and Adobe.

Current State (2025–2026): Under Staples, GitLab has doubled down on AI-powered DevSecOps (GitLab Duo). As of late 2025, the company reported over $750M in annual run-rate revenue and serves more than 50% of the Fortune 100.

The New Era: Bill Staples (Dec 2024–Present)

Bill Staples took over as CEO on December 5, 2024, at a critical juncture for GitLab. While Sid provided the radical transparency and all-remote DNA, Staples was brought in for his proven track record in scaling multi-billion-dollar enterprise software companies.

Profile & Performance Analysis

The “Operator” Pedigree: Unlike many Silicon Valley CEOs who are pure product or sales people, Staples is a mix of both. He spent nearly 20 years at Microsoft and Adobe, where he helped build and scale several multi-billion-dollar cloud businesses.

The New Relic Turnaround: Before GitLab, Staples was the CEO of New Relic. He is credited with shifting their business model to consumption-based pricing and driving a significant increase in enterprise value, which eventually led to New Relic being acquired for $6.5 billion in late 2023.

Focus at GitLab: Since taking the helm, Staples has shifted the company’s focus toward Agentic AI and DevSecOps. He is moving the needle from GitLab being a “developer tool” to a “critical enterprise infrastructure platform.”

Recent Insider Trading & Market Activity

💎 The CEO’s Rare Buy Signal

In a market environment where tech executives often sell shares for diversification, Bill Staples recently made a notable open-market purchase:

Date of Purchase: December 31, 2025

Shares Bought: 3,276 shares

Transaction Value: Approximately $124,750 (at a price of ~$38.08 per share)

Total Ownership: This increased his direct holdings to 345,671 shares.

While 3,276 shares is a small percentage of his total compensation package, open-market buys (using one’s own cash rather than receiving options) are rare in the SaaS world. This purchase occurred following a Q3 FY2026 earnings dip, suggesting Staples believes the market has undervalued the stock’s long-term potential in the AI space.

GitLab Duo: The AI-Native Layer

In 2025-2026, GitLab rebranded itself as “The AI-Powered DevSecOps Platform.” Unlike competitors who bolted AI on as an extension, GitLab integrated it into every stage.

GitLab Duo Chat: A persistent AI assistant available throughout the UI and IDEs. It doesn’t just write code; it summarizes Issues, explains vulnerabilities, and assists with CI/CD configuration.

Agentic AI (New in 2025/2026): GitLab 18.x introduced AI Agents that can perform multi-step tasks. For example, an agent can detect a pipeline failure, perform a root-cause analysis, and automatically open a Merge Request (MR) with the fix.

Model Choice: A key differentiator. Unlike GitHub (locked into OpenAI/Azure), GitLab allows enterprises to choose their LLM (e.g., Google Gemini, Anthropic Claude, or even self-hosted models) to meet data residency requirements.

Integrated Security (DevSecOps)

This is GitLab’s “moat.” While other companies require 3-4 separate tools for security, GitLab builds them into the CI/CD pipeline.

The “Shift Left” Suite: Includes SAST (Static Analysis), DAST (Dynamic Analysis), Container Scanning, and Dependency Scanning. Results appear directly in the Merge Request, so developers fix bugs before they merge.

Continuous Vulnerability Scanning: In 2026, GitLab doesn’t just scan when you push code; it continuously monitors your production images against new CVE databases, alerting you if a library becomes vulnerable months after deployment.

Software Supply Chain: Built-in tools for SBOM (Software Bill of Materials) and build attestation, helping companies comply with new government regulations regarding software transparency.

The CI/CD Engine

GitLab’s CI/CD is widely considered the industry gold standard for flexibility.

CI/CD Catalog: A marketplace-style hub where teams can share and reuse pipeline components, preventing “YAML sprawl” across large organizations.

Merge Trains: A unique feature that queues up multiple Merge Requests to ensure they are compatible with each other before they hit the “main” branch, preventing the “it worked on my machine but broke the build” scenario.

Remote Development: GitLab Workspaces allow developers to spin up pre-configured, cloud-based coding environments in seconds, removing the need for local setup.

The “Ultimate” Upsell

GitLab’s business model relies heavily on moving users from the Premium tier ($29/mo) to the Ultimate tier ($99/mo).

Premium is for scaling (faster builds, advanced CI).

Ultimate is for “C-Suite” needs: Executive dashboards, security compliance reports, and advanced portfolio management.

Why GitLab? The Problem of Toolchain Tax

Before platforms like GitLab, engineering teams suffered from a fragmented workflow. To ship one feature, a developer had to jump between five or more different apps:

Jira for planning tasks.

GitHub for storing code.

Jenkins for testing it.

Snyk for security scanning.

ArgoCD for deploying to the cloud.

This is what GitLab calls the Toolchain Tax. It’s the hidden cost of paying for five licenses, managing five sets of user permissions, and losing hours every week just moving data between tools.

The GitLab Solution: By putting everything in a Single Application, a developer never has to leave the tab. When they fix a bug, the security scan, the test results, and the deployment status all show up in one place (the Merge Request). This results in roughly 7x faster cycle times for most enterprises.

Solving the AI Paradox (2025-2026)

In 2025, GitLab identified a new problem: The AI Paradox. AI was making developers write code 10x faster, but the rest of the company (Security and Ops) couldn’t keep up. The result? A massive pileup of unvetted code waiting to be deployed.

GitLab Duo solves this by applying AI to the entire lifecycle, not just the coding part:

AI for Security: It doesn’t just find a vulnerability; it explains the fix and creates a “Merge Request” to patch it automatically.

AI for Planning: It can summarize hundreds of comments on a project “Issue” so a manager can understand the status in seconds.

AI for Root Cause Analysis: If a deployment fails at 2:00 AM, GitLab Duo analyzes the logs and tells the on-call engineer exactly what went wrong.

The GitLab Cheat Sheet: What These Products Actually Do

For the non-technical reader, GitLab can seem like a collection of buzzwords. Here is a breakdown of the core platform components translated into plain English:

💾Source Code Management (SCM)

What it actually is: A high-tech “Save” button for software.

Why it’s a “Must-Have”: Without it, developers would constantly overwrite each other’s work. It provides a perfect historical record of every single change made to a project, allowing a team of 1,000 to work on the same file simultaneously without chaos.

🏗️ CI/CD Pipelines

What it actually is: An automated “Assembly Line.”

Why it’s a Must-Have: In the old days, shipping software was a manual, error-prone process. GitLab’s CI/CD ensures that every time a developer saves code, it is automatically compiled, tested for bugs, and shipped to the cloud. It’s the difference between building a car by hand and using a robotic factory.

🛡️ Integrated Security

What it actually is: A “Security Guard” at every station.

Why it’s a “Must-Have”: Most companies check for security flaws after the product is finished—which is often too late. GitLab embeds security checks into the assembly line itself. It finds “backdoors” and vulnerabilities the second the code is written, keeping hacker-prone software off the internet.

🤖 GitLab Duo (AI)

What it actually is: An Expert Co-Pilot.

Why it’s a “Must-Have”: Writing code is only 20% of a developer’s job; the rest is debugging, documenting, and sitting in meetings. GitLab Duo handles the boring, repetitive tasks—like writing boilerplate code or summarizing long technical threads—so humans can focus on solving the big, creative problems.

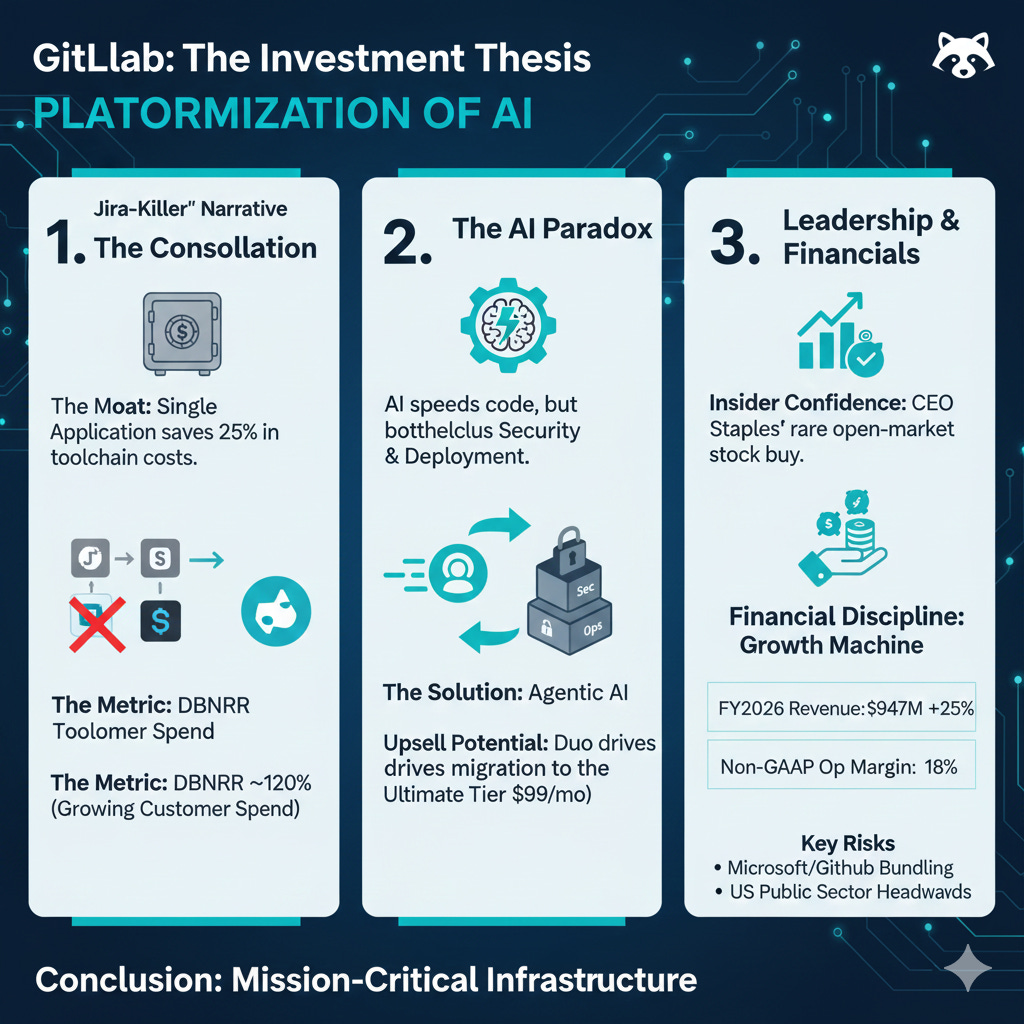

💎 The Investment Thesis: The Platformization of AI

As of early 2026, the bull case for GitLab isn’t just that they are a “GitHub alternative.” It is that they are the only company providing a unified AI-Native Factory that solves the “AI Paradox”, the fact that while AI makes coding faster, it creates massive bottlenecks in security and deployment.

The Consolidation Play (The “Jira-Killer” Narrative)

Enterprises are exhausted by Toolchain Tax. In a high-interest-rate environment, CFOs are mandating the consolidation of software stacks.

The Moat: GitLab is a Single Application. By moving from point solutions (like Snyk for security + Jenkins for CI + Jira for planning) to GitLab Ultimate, enterprises save roughly 25% in total toolchain costs.

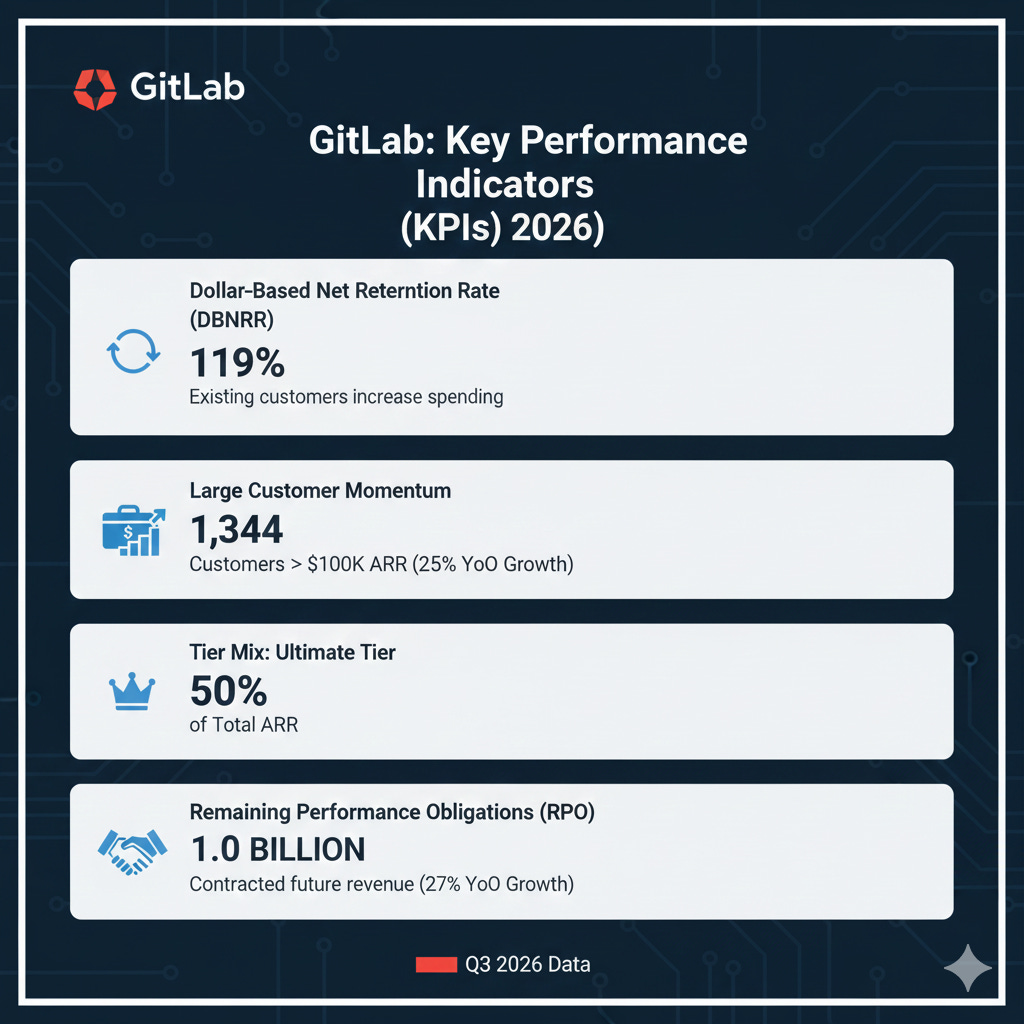

The Metric: GitLab’s Dollar-Based Net Retention Rate (DBNRR) sits at ~120%, signaling that once a customer is in the ecosystem, they spend more every year.

The AI Paradox as a Revenue Driver

Bill Staples (CEO) has pivoted the company to focus on Agentic AI.

Product Market Fit: In 2026, the market has realized that code generation is becoming a commodity. The real value is in AI Orchestration—AI agents that can automatically test code, fix security vulnerabilities, and manage deployments.

Upsell Potential: The “GitLab Duo” AI suite is driving a massive transition from the $29/mo Premium tier to the $99/mo Ultimate tier, significantly increasing Average Revenue Per User (ARPU).

High-Integrity Leadership Signals

Insider Confidence: While the stock has faced volatility in late 2025/early 2026, CEO Bill Staples’ recent open-market purchase of ~3,276 shares (using his own cash) is a rare “Buy” signal in a sector where most executives only sell.

Financial Discipline: For FY2026, GitLab is guiding for $946M - $947M in revenue (up ~25% YoY) while significantly expanding its non-GAAP operating margins to 18%. They are no longer a growth at all costs company; they are a becoming a profitable growth machinfe.

📉 Key Risks to the Thesis

The Microsoft/GitHub Giant: GitHub remains the town square of open source. If Microsoft successfully bundles GitHub Advanced Security with Azure, it could squeeze GitLab’s enterprise market share.

US Public Sector Headwinds: Recent government budget uncertainty (early 2026) has led to slower decision-making in one of GitLab’s key high-growth segments.

The Mission-Critical Bet

The investment thesis for GitLab in 2026 is that DevSecOps is the new Operating System for the Enterprise. As long as companies need to ship secure software faster than their competitors, GitLab can remain must-have infrastructure rather than a nice-to-have tool.

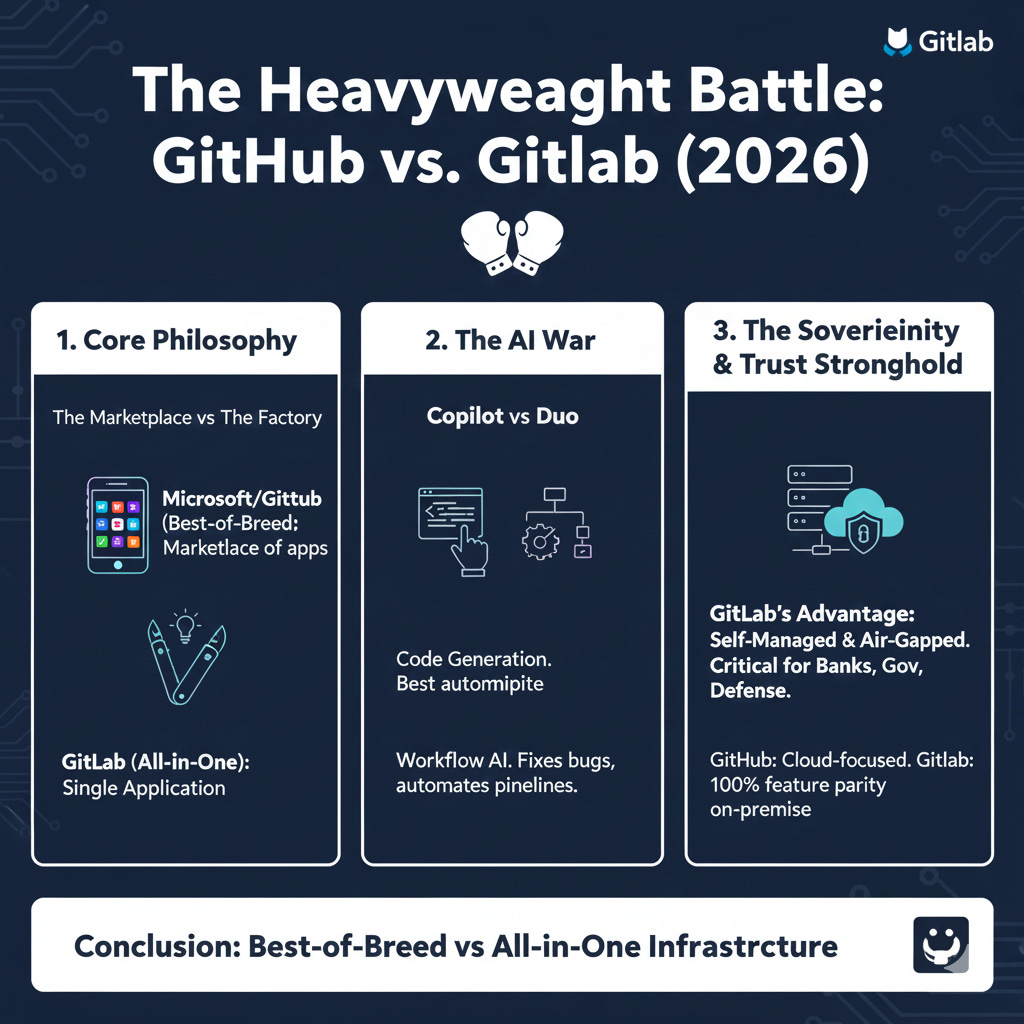

🥊 The Heavyweight Battle: GitHub vs. GitLab (2026)

While both platforms started as places to host code, they have diverged into two completely different enterprise strategies.

Core Philosophy: The Marketplace vs. The Factory

Microsoft/GitHub (Best-of-Breed): Microsoft treats GitHub as a hub. Their philosophy is to provide the best individual tools (Copilot for AI, Actions for CI) but encourage you to plug in other apps. It’s like a smartphone—great out of the box, but you’re expected to download apps from the GitHub Marketplace to finish the job.

GitLab (All-in-One): GitLab’s philosophy is “The Single Application.” They believe every time you switch between different tools, you lose time and security. GitLab is like a Swiss Army knife—every tool you need for the entire software lifecycle (from planning to security to monitoring) is built by the same team and exists in the same interface.

The AI War: Copilot vs. Duo

GitHub Copilot: Leveraging the Microsoft/OpenAI partnership, Copilot is the industry leader in code generation. It is widely considered the most “polished” autocomplete tool for developers.

GitLab Duo: GitLab doesn’t try to beat Microsoft at just writing code. Instead, they focus on workflow AI. Duo excels at the “boring” middle-management tasks: summarizing long technical threads, explaining why a security scan failed, and using AI Agents to automatically fix broken pipelines.

The Sovereignty Stronghold (GitLab’s Advantage)

Nearly 50% of GitLab instances are self-hosted. This is GitLab’s secret weapon.

The “Air-Gap” Market: Banks, Defense Contractors, and Government agencies (like NASA and the DoD) often cannot store their code on Microsoft’s public cloud.

The Winner: GitLab. They offer 100% feature parity between their cloud and self-hosted versions. GitHub’s Enterprise Server is widely viewed as a “second-class citizen compared to their SaaS offering.

🧐 Investor’s Perspective on the Rivalry

The Microsoft Threat: Microsoft can bundle GitHub with Azure and Office 365, making it almost free for companies already in the Microsoft ecosystem. This is a massive competitive pressure for GitLab.

The GitLab Moat: GitLab’s moat is multi-cloud neutrality. Many large enterprises (especially in Europe or highly regulated sectors) are terrified of being “locked in” to Microsoft. GitLab works exactly the same whether you use AWS, Google Cloud, or your own private data center. In 2026, as companies diversify their cloud providers to avoid single points of failure, GitLab is the “Switzerland” of DevOps.

Summary: Who Wins Where?

Choose GitHub if: You want the best AI autocomplete, the largest developer community, and you are already all-in on the Microsoft ecosystem.

Choose GitLab if: You are a highly regulated enterprise (Bank, Gov, Med) that needs total control over your data, or if you want to lower costs by replacing 5 different security and planning tools with one.

GitHub wins on “Breadth”: They have the most users, the most integrations, and the most famous AI tool.

GitLab wins on “Depth”: They have the most integrated security, the best compliance tools, and the most flexible deployment models. They are the “Enterprise Unix” of the coding world.

Investor Note: As Microsoft continues to bundle GitHub into Azure, GitLab’s path to victory lies in “Multi-Cloud Sovereignty.” If an enterprise uses both AWS and Google Cloud, they are much more likely to choose GitLab to avoid giving Microsoft even more leverage over their tech stack.

🏗️ The Duopoly Case: The “Great Squeeze” of 2026

In 2026, the DevOps market has moved past the Wild West phase of hundreds of small tools. We have entered the era of the Two-Horse Race. While competitors like Bitbucket or Harness still exist, GitHub and GitLab have effectively squeezed the middle class of software tools out of the market.

The High Barrier to Entry (The “Platform” Tax)

In the 2010s, a startup could compete by just having a better Code Review tool. In 2026, that is no longer enough. To be a player, you must provide:

AI Orchestration (Agents that write, test, and patch code).

Built-in Security (Scanning for every known vulnerability).

Cloud Infrastructure (Managing the servers where code lives).

Building this All-in-One factory costs billions in R&D. Only Microsoft (GitHub) and the highly efficient, all-remote GitLab have the scale to maintain this depth. This has created a moat of complexity that prevents new competitors from ever catching up.

The Polarization of Corporate DNA

The duopoly exists because GitHub and GitLab have perfectly divided the world based on who has the power in a company:

The Developer-First Pole (GitHub): If your company is driven by hiring the best talent and moving fast, you choose GitHub. It is the Social Network of code. Developers already know it, like it, and have a profile there. GitHub owns the hearts of the engineers.

The Governance-First Pole (GitLab): If your company is driven by compliance, security, and auditor requirements (Banks, Government, Defense), you choose GitLab. It is the Command Center. It offers a level of control and a Self-Hosted option that Microsoft simply cannot match. GitLab owns the trust of the C-Suite.

The Death of Best-of-Breed

In a high-interest-rate environment, CFOs are tired of paying for 15 different software subscriptions.

The Squeeze: Companies are ditching Best-of-Breed (using a separate tool for every task) in favor of the Single Platform. The Result: This consolidation naturally flows to the two biggest platforms. If you aren’t GitHub or GitLab, you are an extra cost that a CFO wants to cut.

The “IOS vs. Android” Paradox

The market isn’t looking for a third option. Just as you don’t see a third major mobile OS (it’s just iOS vs. Android), the DevOps Operating System has settled. GitHub is the Consumer Choice—standardized, social, and everywhere. GitLab is the Enterprise Choice—customizable, private, and secure.

As long as companies are afraid of “Microsoft Lock-in,” GitLab has a permanent seat at the table. This duopoly ensures that both companies have massive Pricing Power, as enterprises now find it too painful and expensive to move their entire “Code Factory” anywhere else.

📈 Revenue Performance

GitLab has maintained strong top-line growth, primarily driven by enterprise demand for its Ultimate tier and GitLab Duo AI platform.

TTM Revenue Trend: The company’s Trailing Twelve Months (TTM) revenue has shown a consistent upward trajectory, reaching $906.2 million by Q4 2025.

Year-over-Year Growth: Revenue grew 31% to $759.2 million for the full fiscal year 2025. In the most recently reported Q3 2026 (ended October 31, 2025), revenue rose 25% year-over-year to $242.4 million.

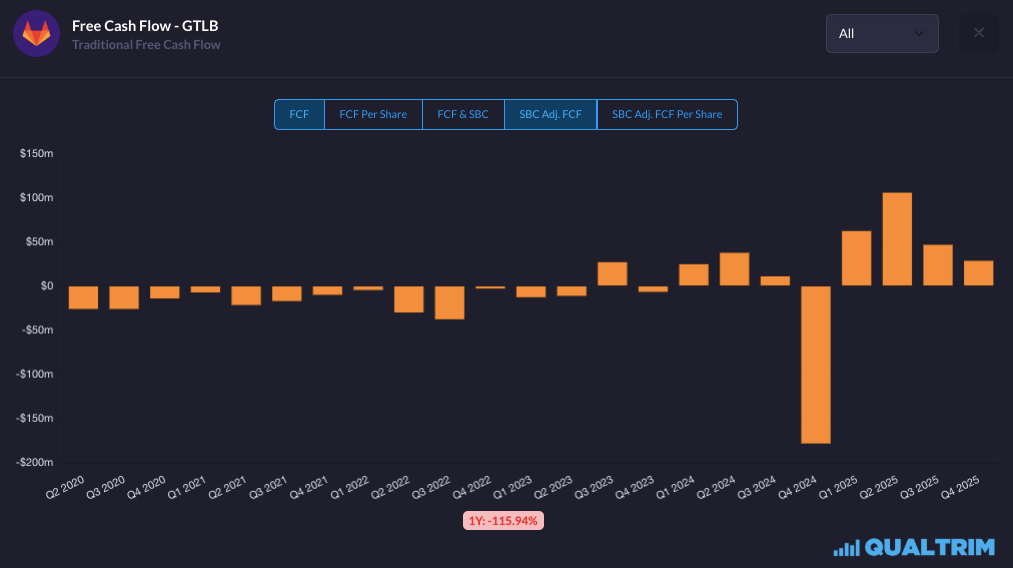

💸 Cash Flow Dynamics

GitLab’s cash flow profile has matured significantly, shifting from consistent outflows to generating meaningful positive free cash flow.

Positive Inflection: After years of negative free cash flow (FCF), the company reported a record adjusted FCF of $242 million over the trailing 12 months.

Quarterly Volatility: While the overall trend is positive, cash flow can be volatile. Q3 2024 saw a significant outflow of $177 million due to non-recurring tax payments related to intellectual property relocation (BAPA).

Current Status: In the latest quarter, GitLab generated $27.2 million in non-GAAP adjusted free cash flow.

🏦 Balance Sheet: Cash & Debt

GitLab maintains an exceptionally clean balance sheet with substantial liquidity and virtually no debt.

Cash Position: As of Q4 2025, the company held $1.2 billion in cash and short-term investments.

Debt-Free Operations: The company reports $0 in debt and $0 in capital leases as of the end of 2025. This lack of leverage provides significant flexibility for future R&D investments or potential acquisitions.

Efficiency Metrics: The current ratio stands at 2.66, indicating a strong ability to cover short-term liabilities with current assets.

📊 Key Performance Indicators (KPIs)

Dollar-Based Net Retention Rate (DBNRR): Stood at 119% in Q3 2026, indicating that existing customers continue to expand their spending on the platform.

Large Customer Momentum: Customers with more than $100,000 in Annual Recurring Revenue (ARR) grew to 1,344 in Q2 2026, a 25% year-over-year increase.

Tier Mix: The highest-level Ultimate tier now accounts for 50% of GitLab’s total ARR.

Remaining Performance Obligations (RPO): Total RPO, which represents contracted future revenue, grew 27% year-over-year to $1 billion in late 2025.

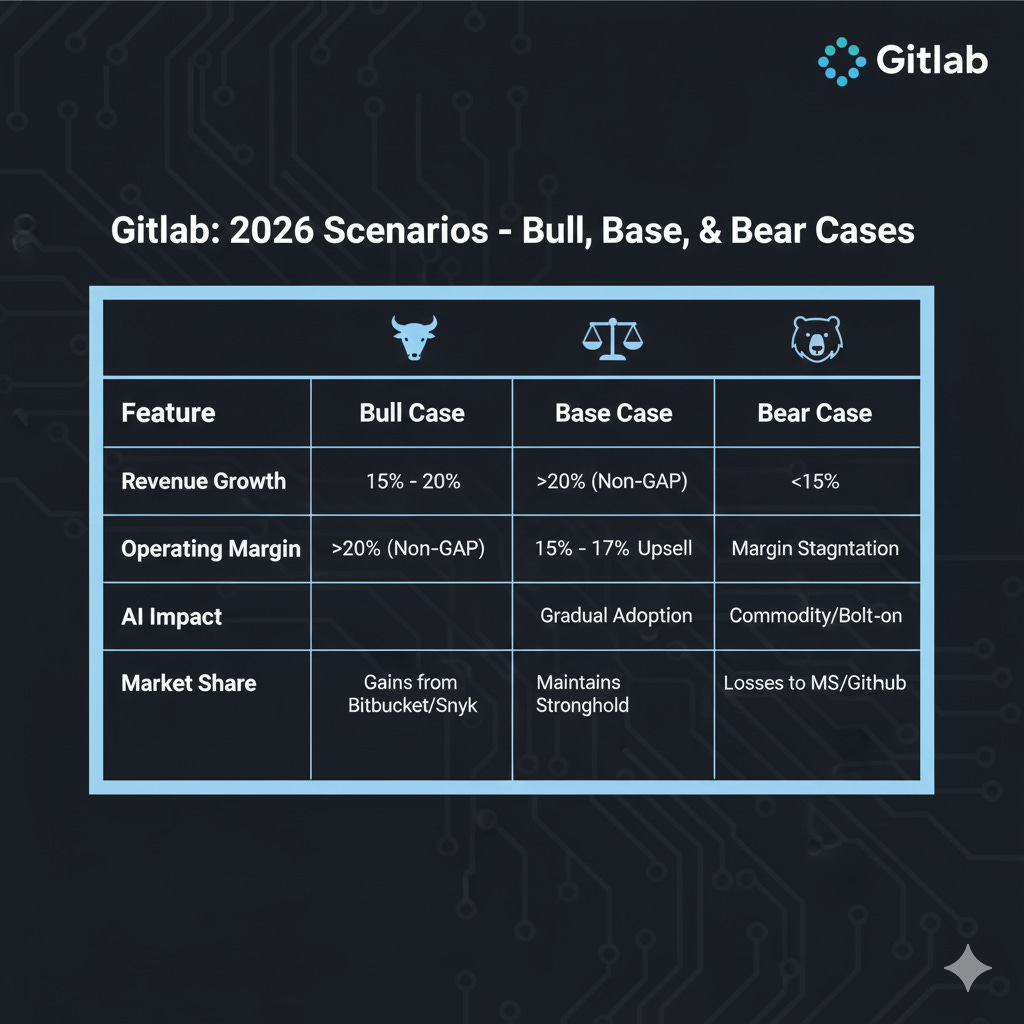

⚖️ The Base Case: The Steady Compounder

The Base Case assumes GitLab continues its current trajectory, growing faster than the market but facing stiff competition and macroeconomic headwinds.

Steady Growth: Revenue growth remains in the 15% to 20% range through 2027, slightly decelerating from the mid-20s as the company matures.

Controlled Profitability: The company reaches GAAP break-even by late 2027 or 2028, while maintaining non-GAAP operating margins near 15-18%.

Market Share Equilibrium: GitLab maintains its 9% market share in SaaS hosting while continuing to dominate the self-managed/on-premise enterprise segment.

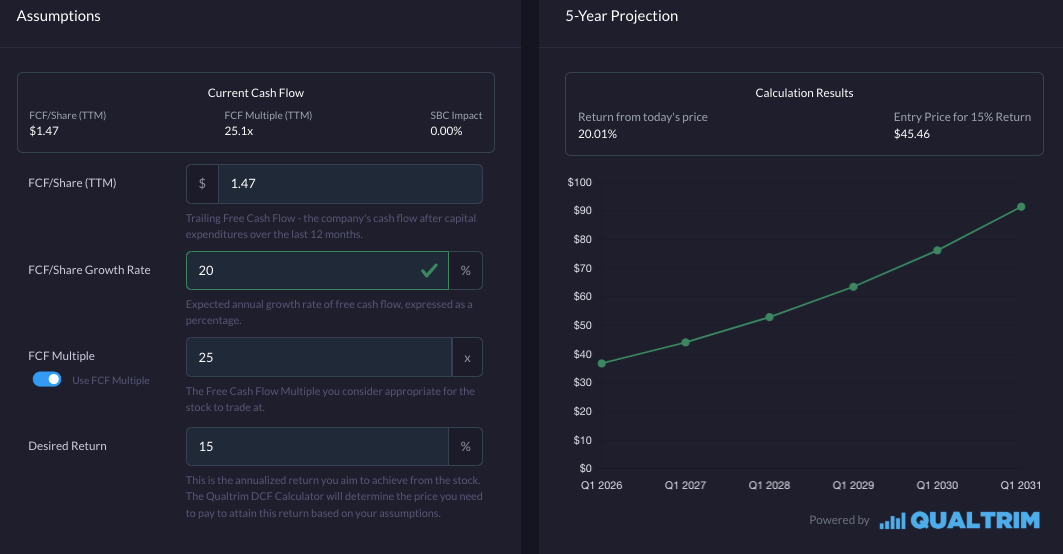

For our base case we can assume growth stays steady but tapers off to the high teens, with some minor margin expansion we get to a 20% earnings growth. With an exit multiple of 25x we get a 20% 5-year IRR.

🐻 The Bear Case: The Squeeze

The Bear Case centers on Microsoft/GitHub successfully using its bundling power to stall GitLab’s enterprise expansion while AI features become commoditized.

Pricing Pressure: Microsoft successfully bundles GitHub Advanced Security into Azure at near-zero cost, forcing GitLab to discount its Ultimate tier to stay competitive.

SMB & Public Sector Weakness: Continued softness in the SMB segment (roughly 8% of ARR) and budget delays in the US Public Sector (12% of ARR) lead to multiple quarters of revenue guidance cuts.

Decelerating Retention: The Dollar-Based Net Retention Rate (DBNRR) slides below 115% as customers opt for seat-count reduction or cheaper point solutions during economic tightening.

Execution Risk: The shift to a hybrid usage-based pricing model creates confusion and churn among existing long-term contract customers, slowing down RPO growth.

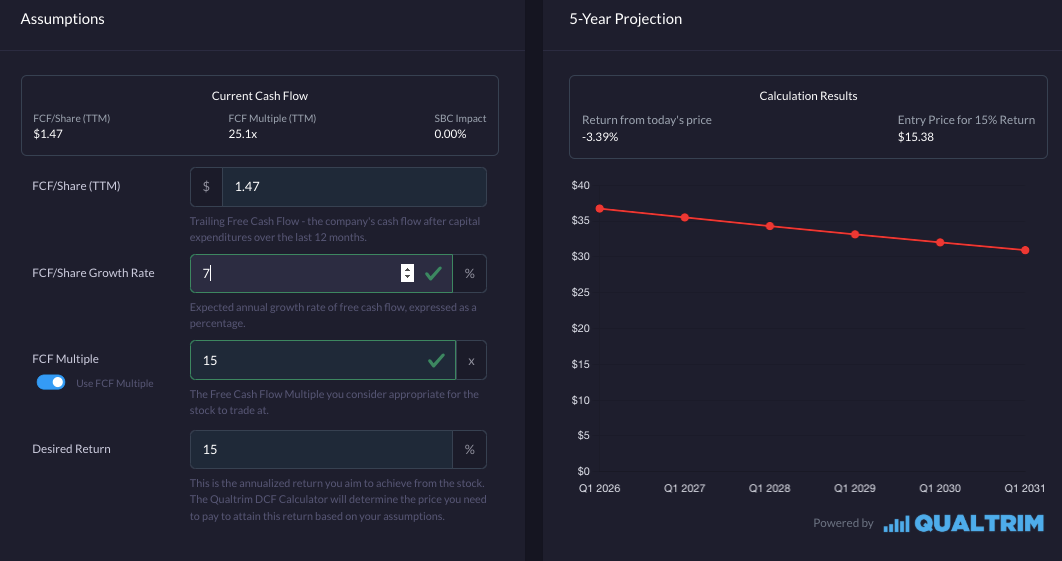

In the bear case I see GitLab getting pressured from GitHub, slowing growth down dramatically from 27% over the last year to 7% over the next 5 years. I set an exit multiple of 15 in this scenario which gets a 5-year CAGR of -3%.

🐂 The Bull Case: The AI Inflection Point

The Bull Case hinges on GitLab successfully converting its Agentic AI vision into a high-margin revenue engine that makes software creation nearly autonomous.

AI Upsell Engine: GitLab Duo and the Duo Agent Platform successfully drive a mass migration from the $29/mo Premium tier to the $99/mo Ultimate tier, which already accounts for 54% of ARR.

Operating Leverage: Revenue continues to grow at a 25%+ clip, while non-GAAP operating margins expand toward the 20-25% range, proving the profitable growth narrative.

Enterprise Dominance: GitLab captures the majority of the “Sovereign Cloud” and high-security market (Defense, Banking) as these organizations mandate model-neutral, cloud-agnostic AI platforms.

Valuation Re-Rating: As free cash flow consistently grows, the market stops valuing GitLab as a risky growth stock and begins valuing it as a mission-critical infrastructure giant.

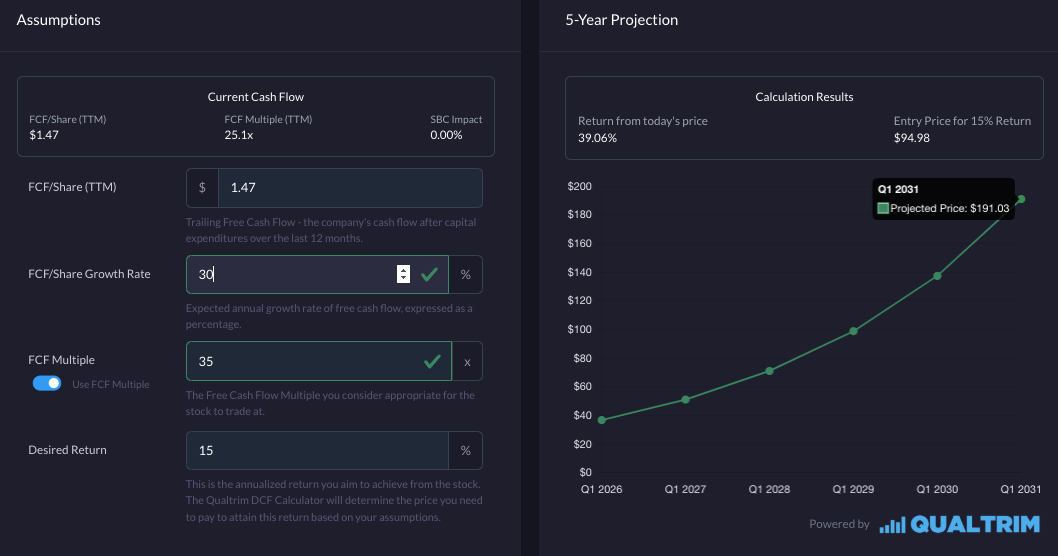

In the bull case GitLab continues to convert customers to its ultimate tier driving high twenties growth, with 1-2% margin growth annually. At an exit multiple of 35 times with 30% revenue growth GitLab returns a 5-year CAGR of 39%, potentially leading to a $191 GitLab.

Final Thoughts

As we look toward the remainder of the decade, the DevSecOps market has matured into a stable duopoly, often described as the "iOS vs. Android" of the developer world. While Microsoft’s GitHub dominates the social "town square" of open source, GitLab has carved out an indispensable and highly profitable private lab for the world's most regulated organizations. Financially, the company has proven its resilience, maintaining 25% year-over-year revenue growth and a strong 119% net retention rate as of Q3 2026. Whether GitLab achieves the aggressive 39% CAGR of a Bull Case scenario, or falls into the 7% growth of a Bear Case depends largely on its ability to convert the broader market to its high-value Ultimate tier and the continued success of its Model Neutral AI strategy. Ultimately, GitLab’s moat, built on multi-cloud neutrality and deep integrated security, makes it a mission-critical infrastructure bet in an increasingly complex and AI-driven digital economy.

Great read! I know both GitHub and GitLab from my daily work with various clients. GitHub is mostly used by the progressive/modern dev teams while gitlab is more used by more traditional tech stacks and companies. A bit like the battle between JavaScript and Java 10-15 years ago.

Looking forward to see if GitLab will get faster adoption in the next few years.

This is a strong take, especially the idea that AI speed is now creating governance and security bottlenecks rather than solving them. One thing I’m watching is how platforms like GitLab are becoming the “translation layer” between rapid AI-assisted code generation and the real-world constraints leaders care about: risk, cost, accountability, and trust.